Welcome to another issue of Front Month, a newsletter covering the biggest stories in exchanges every Friday. If you have questions or feedback, please reply to this email or find me on Twitter. If you like this newsletter and want to follow the exchange industry with me, please hit the Subscribe button below & be sure to share with friends & colleagues:

In Greek mythology, Atlas was a Titan who led a rebellion against Zeus for control of Olympus. When the Titans lost the ensuing war, Atlas received the most severe punishment - holding up the heavens and Earth for all of eternity.

Atlas doesn’t move. When serving his sentence as expected, the Earth hardly notices. We only pay attention to the Earth’s foundation when it shudders or shows any sign of instability.

The last few weeks have shown what an unstable foundation looks like for the world of Wall Street. By now we’ve all heard about the chaos surrounding GameStop, Robinhood, and r/wallstreetbets. The overwhelming volatility has come in such speed and force as to test the routine, mundane underlying structure of the market. Wall Street’s Atlas had its feathers ruffled, and investors have taken notice.

A few informative Twitter threads & news articles have made the rounds mentioning the Depository Trust and Clearing Corporation, or DTCC. DTCC is unequivocally the Atlas of the US financial market, and it benefits investors in exchanges & US equities at large to understand how DTCC works and why it matters to the layman market practitioner.

DTCC was created to help solve a stock market paper problem in the early 1970s. Back then, physical stock ownership certificates had to be exchanged for every trade. Brokers employed armies of back-office administrators to organize, process and send these certificates between each other every trading day. The late 1960s saw a secular boom in equity trading - industry volumes had tripled between 1965 and 1968 to just under 15 million shares per day - and the paperwork needed to manage this volume became utterly overwhelming. At first the brokers and exchanges bent routines to accommodate the surge in paperwork. The NYSE was forced to close every Wednesday to give brokers time for the back office to catch up. Trading hours were shortened the other four days of the week. More back-office clerks were hired, and overtime/night shifts were instituted.

The new measures failed to solve the problem. More certificates were being lost or mis-processed than ever. Brokers were starting to go out of business because they couldn’t keep up with paperwork. Organized crime syndicates were stealing more and more stock certificates in the ensuing confusion. The market was on the verge of a full-blown crisis. Something had to be done.

In response to the mounting pressure, brokers, banks and exchanges convened to devise ways to improve the certificate transfer process. They decided to house all certificates in one place and keep electronic records of trades to cut down on paper usage. If brokers had the paper form of every stock in one room, instead of sending paper all across town when trading took place, they could simply walk it from one side of the room to the other and complete the transaction. Electronic storage made this room virtual, driving even further efficiencies. This new way of processing stock transactions rapidly gained traction with brokers as the 1960s came to a close, culminating in the official formation of DTCC in 1973.

Fast forward 50 years, and DTCC is still serving as the Atlas of Wall Street, growing to become the behemoth of all market plumbing behemoths. in 2019, DTCC processed $2.15 quadrillion in securities transactions - that’s $2,150 trillion, an unfathomable amount of volume. A processing figure in the Q’s makes DTCC the largest clearinghouse in the world by a mile. It isn’t just equity processing either - in fact, stocks aren’t even the majority of what DTCC clears. In addition to centrally clearing all equity trades in the United States, DTCC clears US Treasuries, corporate bonds, mortgage backed securities, and repo transactions making up ~70% of total processing volume. Atlas isn’t shouldering one world, it’s shouldering dozens.

DTCC isn’t a public company, nor is it a government entity, but somewhere in between. Every broker-dealer who uses DTCC to process trades is required to purchase ownership in the company in proportion with their use. The shares have a static price & can’t be traded, nor do they pay dividends. In this regard, the structure of DTCC closely resembles the Federal Reserve - a systemically important, quasi-government entity that requires ownership by its customers with no material financial benefit.

The one feature of DTCC shares that sets it apart is voting rights - broker stakeholders elect DTCC’s board of directors & management. The DTCC board is a who’s-who of the largest banks, exchanges, asset managers and regulators in the world - below gives you some idea of the respective resumes of DTCC leadership:

(Source)

So we have DTCC, a massive clearinghouse shouldering the largest financial markets in the world, with the SEC and Federal Reserve as its overseers, starting to shudder amid the GameStop chaos. Why? What happened?

To answer this, we turn to the brokerages. Stock brokers like TD Ameritrade, Schwab, and Robinhood are at their core, banks. They hold customer deposits in the form of cash & stock, lend money to customers with margin accounts, and manage their balance sheet to maximize profit & (in theory) minimize risk during a normal trading day. When a retail trader places an order to buy or sell stock, brokers will execute their order immediately, but must wait two days for DTCC to fully clear the transaction. During this two day period, the broker is effectively lending money to their customer, taking on credit risk, while the back-office catches up & procures the required stock. When you add short selling, options, and multiple levels of leverage into the mix across millions of customers, you can start to see how complex & fragile the equity trading landscape can become.

Amid this fragility, enter an army of retail traders with coordinated plans to buy stock & OTM call options all at once in one name: GameStop. Brokers execute these orders immediately, then scramble to find shares & cash to meet demand. On the other side of the market, hedge funds who are caught short also scramble to cover positions & de-lever. A wave of orders hits DTCC to process, and during the two day clearing period, GameStop stock triples. Volatility spikes out of control. The options market ceases to function normally. Thousands of new traders sign up with these same brokers and place the same straining orders. More leverage. More scrambling. More backlog at DTCC. If brokers are considered banks, a vicious cycle like the one we’re witnessing with GameStop could be considered a run on the bank.

All brokers are required to hold collateral with DTCC to ensure cash can be found to fill orders at all times. Again, this closely resembles the Fed - DTCC acts loosely as a “central bank” for the brokers managing leverage to run their business. During the week of January 25-29, GameStop’s volatility tested the level of cash held at DTCC. The system could tell it needed more buffer to manage what was coming through its pipes. So DTCC effectively said “party’s over” - it raised the required level of cash brokers needed to have on hand with the clearinghouse. Now on top of managing the tsunami of retail GameStop orders, brokers had to quickly come up with millions more in cash to send to DTCC.

Brokers with conservative buffers would be able to cover this surprise without much threat to their operations. Brokers with more aggressive balance sheets, on the other hand…

(Source: Wall Street Journal, Bloomberg)

In addition to drawing down bank credit lines & raising cash wherever it could be found, Robinhood restricted new positions in GameStop & other “squeeze stocks” for a few days to prevent the bank-run from overflowing further. This didn’t sit well with customers, regulators, and the media, many of which taking the chance to tie Robinhood’s actions to a larger conspiracy theory that Citadel put pressure on them to halt trades because they were losing money:

I recount this story to make two points - the first is that much of the immediate reaction to the above headlines was more attention & engagement-grabbing in nature than the actual truth. Is Citadel completely free of wrong-doing? I have no idea. Have they been active in the GameStop events of these past couple weeks? Absolutely. Reports are surfacing that Citadel has made a fortune trading the volatility. Why pressure your top broker to stop the flow of profits? The Citadel theory also doesn’t explain Robinhood raising so much cash so quickly. The much more plausible story is an order by DTCC to raise funds given the extraordinary short term swings in GameStop stock.

The second point is that more attention - way more attention - needs to be directed towards DTCC, its leadership and its oversight. They are quite literally a quadrillion dollar point of failure, so when systems or processes change at the clearinghouse, investors & the media alike need to be cognizant to the downstream impacts.

If layman investors are hearing about DTCC on the evening news, it’s normally not a good thing. It means Atlas is adjusting his grip on the foundation of Wall Street, and someone is feeling the quake way up on the surface.

I have a feeling this won’t be the last time DTCC comes up this year. r/wallstreetbets is only growing in size & influence, and until regulation or stimulus plans change, casino-like equity markets & volatility in general is here to stay.

Good luck Atlas. May your strength not fail anytime soon.

More Exchange Earnings

Earnings season moved towards peak intensity this week as multiple exchanges released Q4 2020 results & gave helpful commentary on the 2021 environment & outlook. ICE and Tradeweb released results on February 4th & CBOE is set to release results the morning of February 5th. You can find my review of ICE earnings below - be on the lookout for my reviews of Tradeweb & CBOE’s earnings in the coming days.

Honorable Mentions

On February 2nd, Tradeweb announced it had agreed to purchase Nasdaq’s fixed income business (formerly known as eSpeed) for $190 million. Nasdaq purchased eSpeed back in 2013 for a whopping $750 million and future equity payments to BGC Partners, the seller. While certainly an ugly financial loss for Nadsaq, the deal frees up working capital & divests another non-core asset so CEO Adena Friedman can focus on investment in Market Technology, indices & anti-finCrime growth. For Tradeweb, the addition of eSpeed adds new customers & volume to its already strong US Treasury business, and sets it up for more intense competition with CME’s BrokerTec, the top player in dealer-to-dealer US Treasury trading.

On January 29 XTX Markets CEO Alex Gerko published a very thought-provoking piece on the state of retail trading, payment for order flow, and ideas to improve the system the way market makers & exchanges are incentivized. You can find that piece HERE.

Chart of the Week

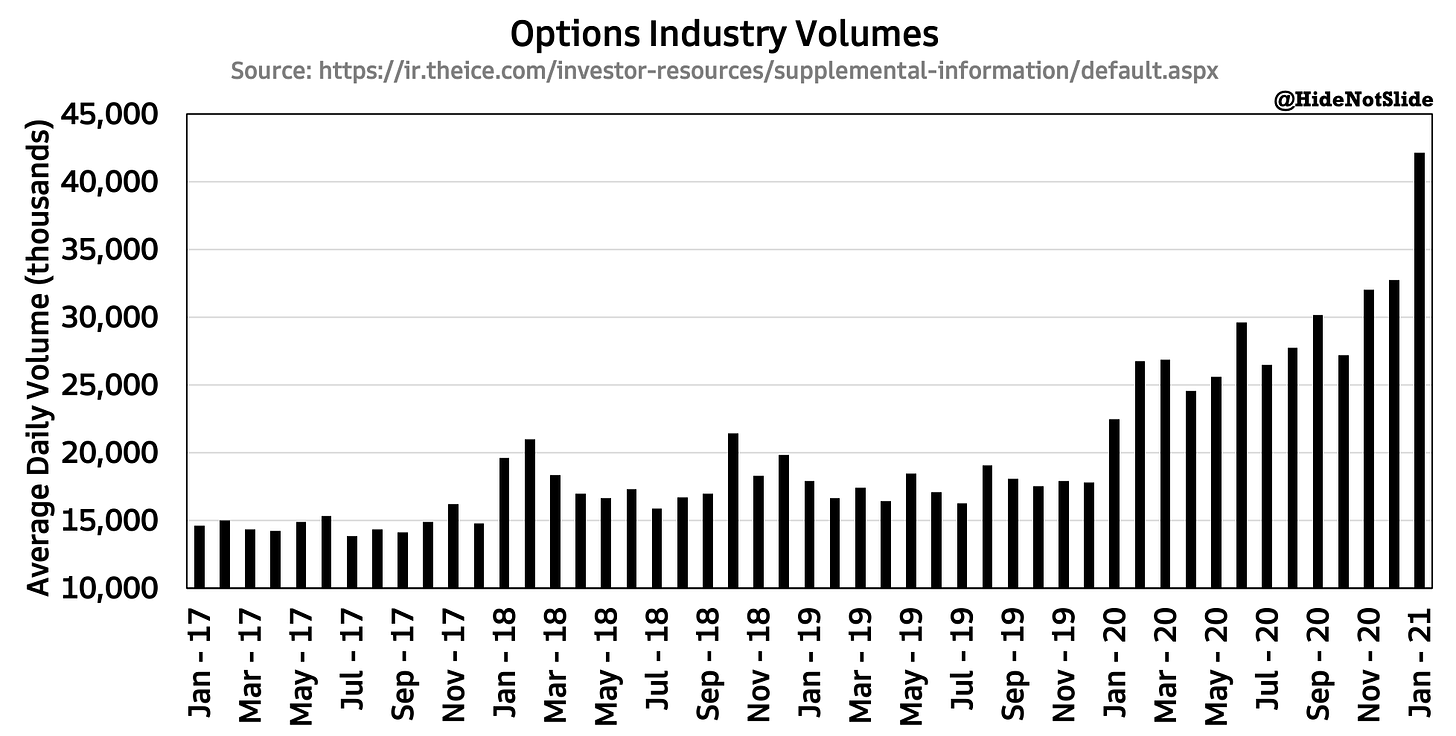

I’ve shown this chart multiple times in the past, but I keep bringing it up because it keeps blowing my mind. Options industry volumes hit another all-time high in January 2021, blowing past previous records (set in December 2020) by +29%. The retail uprising surely had a hand in the activity - Robinhood signups have surged & media coverage of the stock & options market was intense last month. While we may see some mean reversion as Q1 rolls on, I predict options volumes will keep surging. Even if people leave Robinhood for other brokers, the appetite for gambling in this market environment is as high as it’s ever been, and trading friction continues to be low.

I may want to frame this chart once a few more months in 2021 have finished… one for the history books:

Thank you for reading this issue of Front Month. Word of mouth is the #1 way others find this newsletter - If you liked this week’s content, please consider sharing with friends & colleagues. Questions & feedback can be sent via email or Twitter.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, CBOE, NDAQ and VIRT. I am also long Bitcoin.