Moral Hazard, Power & The London Metal Exchange

Welcome to another issue of Front Month, a newsletter covering the biggest stories in exchanges & market structure every Friday. If you have questions or feedback, please reply to this email or find me on Twitter. If you like this newsletter and want to follow the exchange industry with me, please hit the Subscribe button below & be sure to share with friends & colleagues:

Financial crisis.

The phrase means something different to each of us. To some, it’s a reminder of a particularly challenging season of life when personal finances were beyond tight & the future seemed dark & uncertain. For others, it sends them back to a volatile but life-altering period when opportunities appeared, risks were taken & immense amounts of money were made. For most of us, the term “financial crisis” means the period from 2007-2009 when the global financial system nearly collapsed. When the music almost stopped.

When I hear the term “financial crisis”, I certainly think about that period of time, but I also think about today. Right now. Make no mistake - the events surrounding the short squeeze & subsequent halt of nickel trading on the London Metal Exchange have all the makings of a financial crisis. Hubris. Over-leverage. Complacent banks. Too big to fail institutions. The near collapse of a critically important market. Bailouts. It’s all there, and it’s something I think we’ll be talking about for many years to come, in market structure circles & beyond.

What Happened?

Tsingshan Holding Group, headquartered in China & owned by billionaire Xiang Guangda, is the world’s largest producer of nickel, a critically important part of modern industrial production with meaningful uses in cars, jet engines, phones, batteries & other household items. Through their normal course of business, Tsingshan & other producers are heavily exposed to the volatile price of nickel, and use futures to hedge risk & lock in prices that guarantee sufficient profit margins. These futures trade on the London Metal Exchange, which has been in business since the 1800s and launched nickel futures in the 1970s. For years Tsingshan & other producers have safely used LME’s market to do business & offer competitive prices to everyday consumers.

Then, in 2022, Tsingshan enacted a plan to dramatically increase nickel production for use in electric vehicles, which led Guangda to believe that prices were bound to drop in the coming months. Tsingshan’s nickel short position, normally used to hedge existing production, ballooned to reflect Guangda’s view.

Guangda made a big, leveraged bet. A deep bench of brokers led by JPMorgan Chase gave Tsingshan the leverage it needed to make this bet, and trading firms like Glencore & Trafigura took the other side of Tsingshan’s position. The stage was set - who would win out? The billionaire nickel tycoon or the hedge funds & trading firms who thought he was wrong?

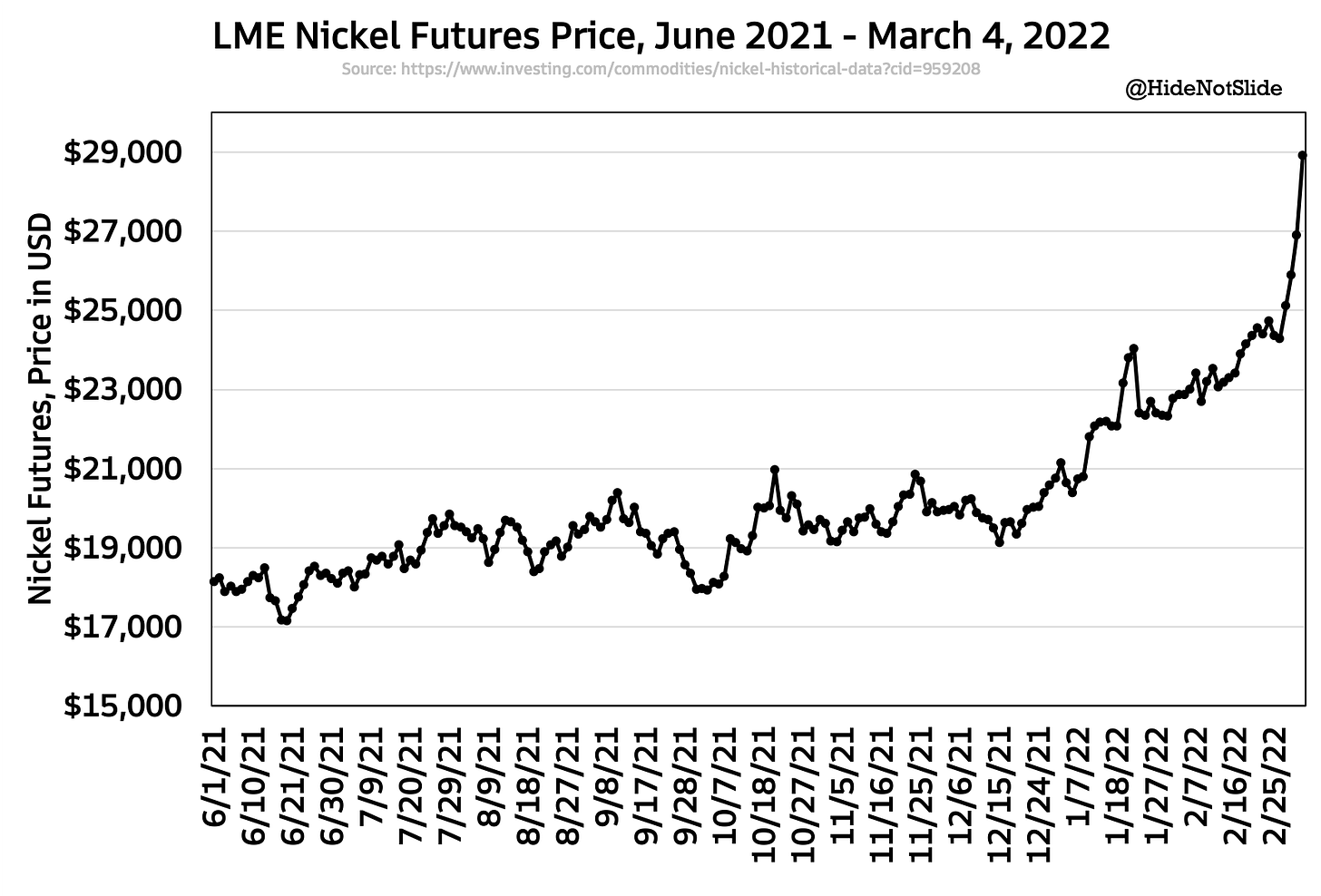

In late February Russia invaded Ukraine and crippling sanctions cut its economy off from the rest of the world. Russia is the world’s third largest producer of nickel - without access to its market, nickel faced an immediate & unavoidable supply shock. Prices spiked higher:

Guangda made a big, leveraged bet, and he was WRONG. He was sure the price of nickel would be going lower, much lower over the next few months & years, and he was wrong. Plain and simple.

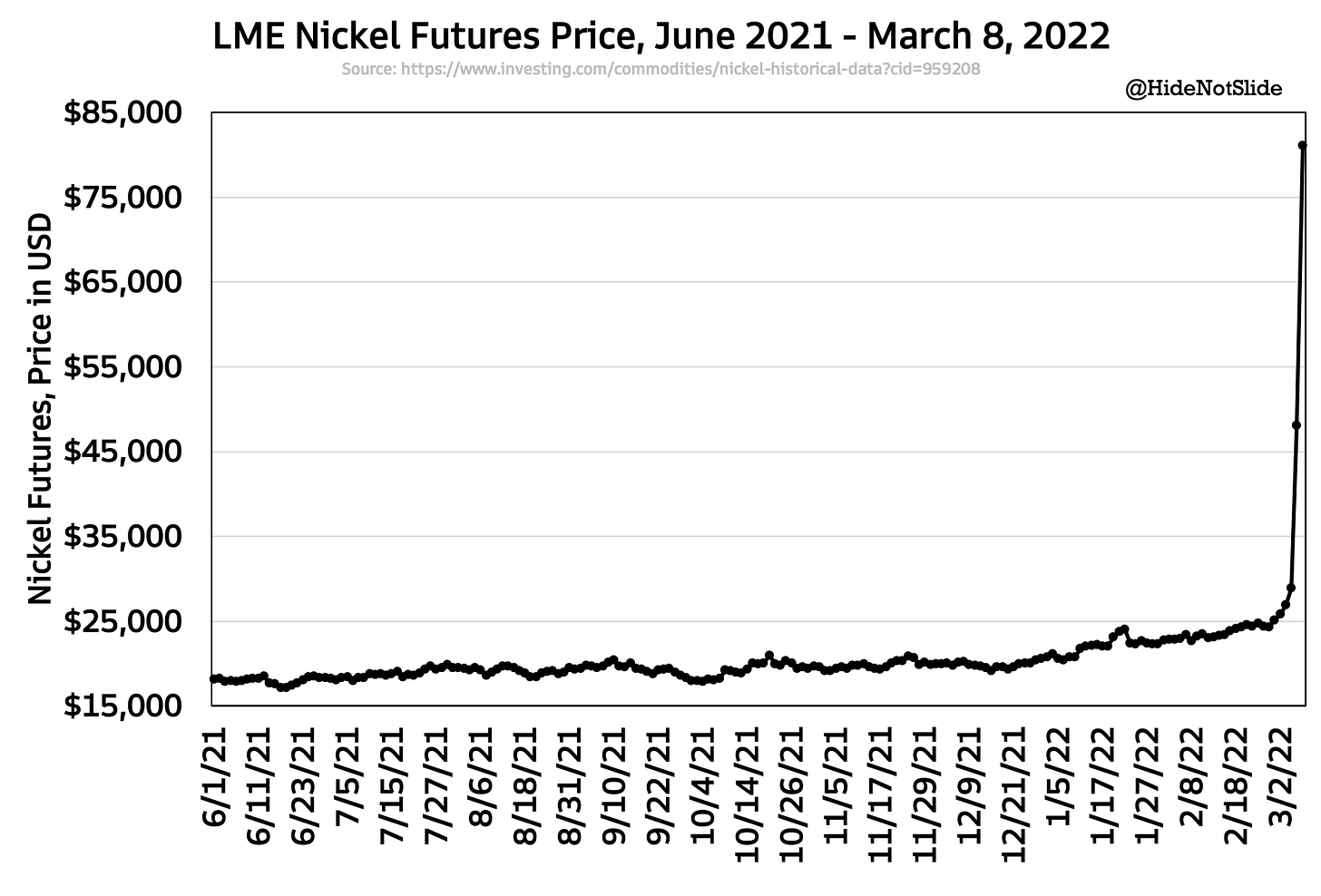

As nickel continued to spike, Tsingshan faced deeper & deeper margin calls. It paid what it could with collateral on hand, but soon found it had no money to pay off its losses. It started buying futures to help cover its short position, which pushed prices up even higher. On March 8, the resulting buying pressure created a short squeeze of historic proportions:

At its peak Tsingshan faced margin calls totaling over $3 billion, more than twice its normal annual earnings. It didn’t have the cash to pay & left its banks & brokers stuck with the bill, which would likely have caused many of the smaller ones to fail & JPMorgan to suffer serious pain. A financial crisis stared the nickel market & the London Metal Exchange dead in the face & left executives with little time to come up with a solution.

LME officials convened an emergency meeting & made a decision that averted immediate crisis, but shook the foundation of its 200 year old market in the process.

A Pyrrhic Bailout

“The LME has been monitoring the impact on the LME market of the situation in Russia and the Ukraine, as well as the recent low-stock environment and high pricing volatility environment observed in various LME base metals and in particular Nickel.

With immediate effect, and following the suspension of the LME Nickel market announced in Notice 22/052, the LME (acting where required through the Special Committee) has determined that it is appropriate in the circumstances to take the following actions in respect of physically settled Nickel Contracts:

(i) cancel all trades executed on or after 00:00 UK time on 8 March 2022 in the inter-office market and on LMEselect until further notice (Affected Contracts); and

(ii) defer delivery of all physically settled Nickel Contracts due for delivery on 9 March 2022 and any subsequent Prompt Date in relation to which delivery is not practicable (as determined by the LME and notified to the market) owing to a trading suspension in line with the process in this Notice. “

(Source - LME Notice dated March 8, 2022)

The LME decided to execute the full extent of its power as an exchange and announced the cancellation of all nickel trades on March 8. The trading receipts? Rip them up. The gains & losses between an orderly & functioning market? Reverse them. The margin calls? Take them back. The London Metal Exchange dusted off its trading time machine & used it to, at least on paper, make it seem like the nickel short squeeze on March 8 never happened.

This is an unprecedented show of power by a modern exchange. Exchanges have canceled certain erroneous trades here & there in the past, but have never come close to erasing entire trading days from existence. The downstream impacts of this decision are enormous.

Remember those traders on the other side of Tsingshan’s short position? The ones who bought nickel futures, took significant market risk, and were right? They were outraged. Billions of dollars in gains had been wiped out at the behest of the LME, and firms who were long suffered as a result. Remember - most traders don’t make naked long or short bets in a market as volatile as nickel. They make pair trades - long nickel, short copper. Long LME nickel, short Shanghai nickel. Long the front month, short the back months. When the LME canceled trades in one of its markets, it didn’t cancel all metals trading across all exchanges around the world. It turned back time only where crisis lied waiting, leaving other trading histories untouched. So when a trading firm has one leg of their pair trade removed from existence, a winning bet suddenly becomes a massive loss.

For example - XTX founder Alex Gerko tweeted a screenshot of his firm’s YTD PnL in nickel trading - a steady trend upward in gains crashes down to near zero on March 8:

When the head of a well-known & respected market-making firm like XTX says “it’s the end of the market”, you know something is terribly wrong.

LME erased a bankruptcy-inducing loss by one of its biggest commercial clients, but at what cost?

Friends Don’t Let Friends Blow Up

On the other side of the trade, the LME’s decision bought Tsingshan time to find collateral for its still sizable short position & negotiate new borrowing terms with its creditors. As if the outrage wasn’t already high enough, Guangda was allowed to keep his short open. His firm is so big & influential in the nickel market that he can take massive positions one way or the other & get the LME to bail him out if he’s wrong, at the expense of everyone on the other side of his trade. Tsingshan has become too big to fail, and now everyone knows it. THIS is why traders who’ve for years been active LME participants are starting to walk away from the exchange. When agreed-upon rules of market trust & fairness are violated, defections follow.

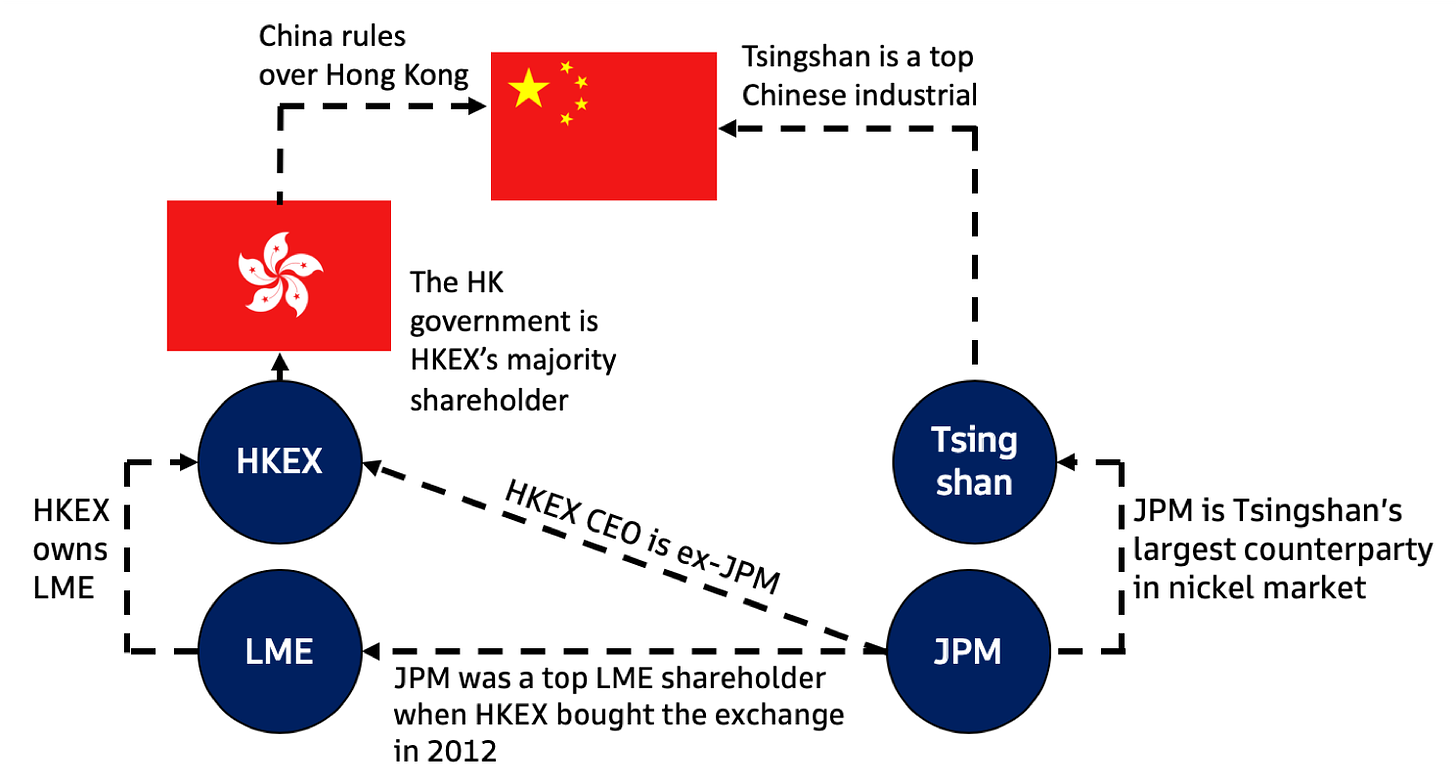

Why would the LME do this? Why make such a structurally harmful decision to keep Tsingshan in business? At the end of the day, I have no idea. I wasn’t in the room when LME officials made the final call. I don’t know what made them favor one side of the market over the other. What I do know, however, is that the LME and its owner, Hong Kong Exchanges & Clearing (HKEX), have close ties to both China & JPMorgan, Tsingshan’s largest counterparty. If I had to guess, I’d say these ties might have influenced the LME’s decision to favor one set of parties over the other.

The web of relationships between JPMorgan, LME, HKEX and China is a deep & complex one - without going down the conspiracy theory rabbit hole, I do think it’s worth understanding how these entities overlap:

My Thoughts

Trust is a sacrosanct part of market structure. It underpins the very existence of a free market. I can comfortably buy Apple stock because I trust my brokers, the exchange, and the clearinghouse to custody my money & pay me my gains or losses when they’re incurred. Airlines buy oil futures because they trust the exchange to pay them out if the price of oil goes up. Market makers hold billions of dollars of inventory & post quotes on every exchange in the world because they trust that the rules of those exchanges will be upheld. If that trust is lost, the market is lost.

We may be witnessing the beginning of the end of global trust in the London Metal Exchange, and I honestly don’t know what the downstream impacts of that will be. Liquidity will likely fade over time. Spreads will widen, the cost of hedging metals production will go up, and global consumers will likely feel the impact to their wallet at some point. Trust has a price, and that price is likely about to go up if the LME is involved in your supply chain.

We also cannot ignore the influence China has over the London Metal Exchange. The Hong Kong government literally has direct ownership control over the exchange’s parent company, and can influence its leadership appointments, long-term strategy & investment decisions. With Hong Kong now fully in the shadow of the Chinese Communist Party, it would be foolish to think that China wouldn’t seek to exert power over a venue as important as the LME, particularly considering its activity in other high-profile industries. The fact that a China-linked exchange reversed trades to protect a Chinese industrial giant should not go unnoticed.

What can affected banks & institutions do in response? They can try and start their own exchange, taking market share from the LME and making global trust a priority. It’s unlikely to work, but if enough large metals market participants are outraged by the exchange’s move, this may be more of a possibility than in the past.

This may also serve as a convenient excuse to pursue blockchain-based trading of assets where traders are not able to trust a centralized third party to honor transactions. I’m sure legacy metals trading firms who criticized DeFi & blockchain technology are now taking a second look at the concept. When market trust has been broken, using a trustless way to transact may become much more attractive.

There are those who believe the LME did the right thing by tearing up an entire day’s worth of trades. They think the prospect of failed brokers, a wounded JPMorgan, and possibly a bankrupt Chinese nickel producer is too painful to entertain. I disagree. In order for markets to work as safely & efficiently as possible, actions must have consequences. Tsingshan, JPMorgan & other involved brokers took too much risk, and their bets were wrong. They should be required to pay the consequences.

On the contrary, the prospect of a hollowed out, fake market, where the small can’t win and the big & politically-connected can’t lose - THAT is a future too painful to entertain. I sincerely hope today’s saga at the London Metal Exchange isn’t moving us closer to that kind of endgame.

Thank you for reading this issue of Front Month. Word of mouth is the #1 way others find this newsletter - If you liked this week’s content, please consider sharing with friends & colleagues. Questions & feedback can be sent via email or Twitter.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, TW, SPGI, NDAQ and VIRT. I am also long BTC, ETH, LOOKS and SOL.