Welcome to another issue of Front Month, a newsletter covering the biggest stories in exchanges & market structure every Friday. If you have questions or feedback, please reply to this email or find me on Twitter. If you like this newsletter and want to follow the exchange industry with me, please hit the Subscribe button below & be sure to share with friends & colleagues:

A tragic accident changed Tim Reynolds’ life forever one cold New York night on December 14, 2000.

Reynolds had hailed a cab after attending a holiday party in the city, and was asleep in the back seat when his driver crashed into the median on the Pulaski Skyway. Reynolds was jolted awake, realized the cab driver had fallen asleep at the wheel, and turned just in time to watch another car slam into his side, pinning him to the cab’s door. Paramedics arrived and quickly transported Reynolds to University Hospital in Newark, where doctors were able to save his life after emergency surgery.

“I was fortunate,” he would later recount in an interview - “I had two great doctors looking after me.”

Reynolds would spend the next three months in the hospital. Although his life was spared, his spinal cord had been crushed in the accident, and he was left paralyzed from the waist down.

He was 35 years old.

He had a wife and kids at home.

And he had just co-founded a high frequency trading firm called Jane Street Capital.

Fast forward two decades, and Jane Street is a global trading behemoth. The firm traded more than $9 trillion of securities in 2020, including 10% of the entire US ETF market and nearly 5% of the US equity market. They made more money in the first half of 2020 than rival Citadel Securities made all year. Their name has come up in conversations about systemically important trading firms in certain asset classes. And yet despite Jane Street’s long shadow cast over global financial markets, we barely hear anything about them, save the occasional press release or hush-hush quote here and there.

How did Tim Reynolds & his upstart firm manage to do it? What brought Jane Street from a small group of traders & coders to arguably the largest & most successful HFT firm in the world?

Training Grounds

Reynolds’ interest in what would become Jane Street began at Cornell business school, where he enrolled in 1992 after brief stints in real estate & as a bartender in Turks & Caicos. Classes that mentioned arbitrage - making risk-less profits by solving market mispricings - fascinated Reynolds the most, and drove him to find a job where he could study & exploit arbitrage opportunities in real time.

What firm understood the business of arbitrage better than anyone else? Susquehanna, the Pennsylvania poker whiz kids who were becoming a serious force in the options market by the time Reynolds left school. He took a job with Susquehanna in the mid 90s and began his training, studying the relationship between risk, reward & price as it related to evolving US market structure.

And the market was indeed evolving. January 1993 saw the invention of maybe the single greatest financial product of the century - the exchange traded fund, or ETF. State Street’s S&P 500 ETF - the first of its kind listed in the US - gave investors convenient, liquid access to the world’s most popular benchmark at an affordable cost, with arbitrage as the product’s backbone. Market-makers like Susquehanna could partner with State Street, manage a portfolio of both the ETF and its underlying stocks, and trade between the two when prices moved out of line with each other. Not only were they providing a valuable service to State Street & ETF holders by doing this, they were getting incredibly rich in the process. Reynolds sharpened his trading skills & understanding of ETFs in the presence of arbitrage royalty.

As the ETF market grew in size & variety, arbitrage opportunities between them all grew exponentially. It started with ETFs of large cap stocks. Then it moved to mid & small cap stocks. Then international stocks. Then gold. Then Treasury bonds. Then international corporate bonds. Then volatility futures. The list could go on & on - if a market existed, an ETF was made to give liquid exposure to that market, whether the underlying assets were heavily traded or not. Susquehanna became the kid in an ever-expanding arbitrage candy store as it worked to keep all these new, esoteric products trading in line with their underlying assets.

As the mid 90s stretched into the late 90s, Reynolds realized the ETF space was big enough to accommodate more than one HFT firm, and left Susquehanna to set up Jane Street with co-workers Rob Grenieri & Michael Jenkins. The trio likely received some backlash for their decision to leave - rumor has it Susquehanna CEO Jeff Yass doesn’t take well to defections:

“Jeff Yass has gone into tirades when traders leave for other firms or go out on their own, taking what they’ve learned from him and making their own millions. He argues that it’s wrong, what they’re doing, getting rich off of Susquehanna ideas. Because they are his.”

(Source)

With trading skills forged at Susquehanna & intimate knowledge of the ETF market, Jane Street’s founders seemed well-equipped to take on their former employer & ride the arbitrage wave to riches. Reynolds & team would soon find out, however, that the road to the top of HFT would prove exceedingly long & difficult to travel.

The OCaml Advantage

Most proprietary trading firms have really smart people working for them. Most firms have big budgets to buy the best equipment. Most firms enter with expertise in a particular part of the market. And most firms fail.

Jane Street had all the ingredients of a successful prop shop, but what would separate them from competitors? What would be their edge in a field where edge was extremely difficult to come by?

After only a couple years in their life as a firm, Jane Street decided to cultivate edge through the programming language OCaml, a small, niche, mostly academic language not widely used in the trading community. Most HFT firms use code that optimizes for speed, leading them to efficient, bare bones languages like C, C++ and Java. OCaml is similar to these languages in speed but has key syntactical differences that keep it from a firm’s first language of choice. Despite its moniker as a fringe coding language OCaml became Jane Street’s primary tool to build its trading systems & infrastructure. Why?

To understand Jane Street’s strategy, we need to go back to a 2004 theory posited by YCombinator founder Paul Graham called the Python Paradox:

“If a company chooses to write its software in a comparatively esoteric language, they'll be able to hire better programmers, because they'll attract only those who cared enough to learn it.”

(Source)

In the early 2000s Python was not the ubiquitous coding language it is today, as mainstream computer scientists were focused on Java. Graham argued that programmers who knew Python in 2004 were better than those who knew Java because they cared enough to learn an unpopular language. OCaml takes the Python Paradox to the extreme - only the best of the best would pass up Java AND Python to learn a language as fringe as OCaml. Jane Street’s primary language acted as a natural filter for its best developers.

This strategy seemed like a good idea on paper. In reality, it proved extremely difficult in the early years because there were so few OCaml developers able to work at the firm. To survive & grow while constrained by its programming language, Jane Street’s lead developer Ron Minsky went on a public recruiting campaign to elevate OCaml’s status and convince aspiring employees to adopt it. Minsky gave lectures at top universities around the country & pushed schools to add OCaml to their curriculum. He set up OCaml boot camps for Jane Street new hires to help them overcome the steep learning curve. He even launched a Jane Street sponsored podcast to spread awareness & highlight some of the firm’s projects.

As Jane Street’s OCaml gospel tour continued over many years, the firm’s toughest challenge slowly became its greatest asset. Elite developers began signing on to work with Jane Street and exploit arbitrage through code. A deep shared knowledge of the unique language made for easier error-catching, higher productivity, and better employee retention. Overlaying Reynolds’ ETF knowledge with this powerful team of OCaml coders gave Jane Street the advantage they needed to not only survive as an HFT firm, but ascend to the top of the industry’s food chain.

The Arbitrageur’s Royal Bloodline

Today ETFs are a massive, popular, multi-trillion dollar asset class with Jane Street as one of its largest market makers. The firm trades more than 5,000 ETFs globally with nearly $4 trillion in annual volume. Their market-making prowess was put to the test during 2020’s COVID chaos as liquidity vanished & many feared that ETFs - particularly in fixed income - would collapse & cause a bigger meltdown. Jane Street’s trading systems helped keep these complex instruments from unraveling & made a fortune when calm returned, minting more than $6 billion in profits in 1H 2020 alone.

I like to think of Jane Street’s expertise in arbitrage as a kind of royal treasure, begrudgingly passed down from Jeff Yass and Susquehanna to Jane Street’s founders. Both firms are extremely tight lipped about their trading strategies & methods to prevent others from stealing their treasure. Recently a new royal descendent has emerged - Sam Bankman-Fried, the ex-Jane Street celebrity crypto trader who rose to fame by exploiting the Kimchi Premium - the huge spread between crypto prices in Korea & the US - to become a self-made billionaire before age 30.

Arbitrage, like in the ETF market, is the key backbone of crypto market structure. Everything from Bitcoin futures to offshore exchanges to DeFi relies on arbitrage to function properly. Susquehanna, Jane Street, and now Bankman-Fried have become masters of arbitrage, which in turn has made them masters of the market itself.

Today Tim Reynolds is no longer at Jane Street. In a wheelchair since his tragic car accident, Reynolds still commuted to New York for work every day before retiring in 2012 to focus on philanthropy & honing his skills as a talented artist. In his place Jane Street continues on as a dominant member of the Arbitrage Royal Family, protecting its treasured knowledge & using it to make its owners wealthy & global markets more efficient.

Honorable Mentions

The ever-raging US equity market structure debate erupted once again this week as a few notable headlines hit the tape. First, the Financial Times published an interview with XTX CEO Alex Gerko on payment for order flow & the state of retail equity trading costs. Gerko believes the current model is broken, saying that while headline commissions are $0 the hidden costs of wider bid/ask spreads offset this and more. Gerko argues that costs would come down & markets would become more efficient if retail flow was executed on an exchange, forcing market makers to compete with other participants for retail trades.

Additionally, SEC Chair Gary Gensler gave a speech at a recent investor conference on the same subject, where he talked about market concentration among wholesalers & how the NBBO isn’t a competitive benchmark for equity prices. Virtu’s stock dropped 5-10% during Gensler’s speech, indicating a spike in anxiety about the SEC’s stance against it and the industry more broadly.

ForUsAll Inc, a small 401K provider with ~1.7 billion in retirement assets, announced they’ve partnered with Coinbase to offer crytpo investment options to their clients.

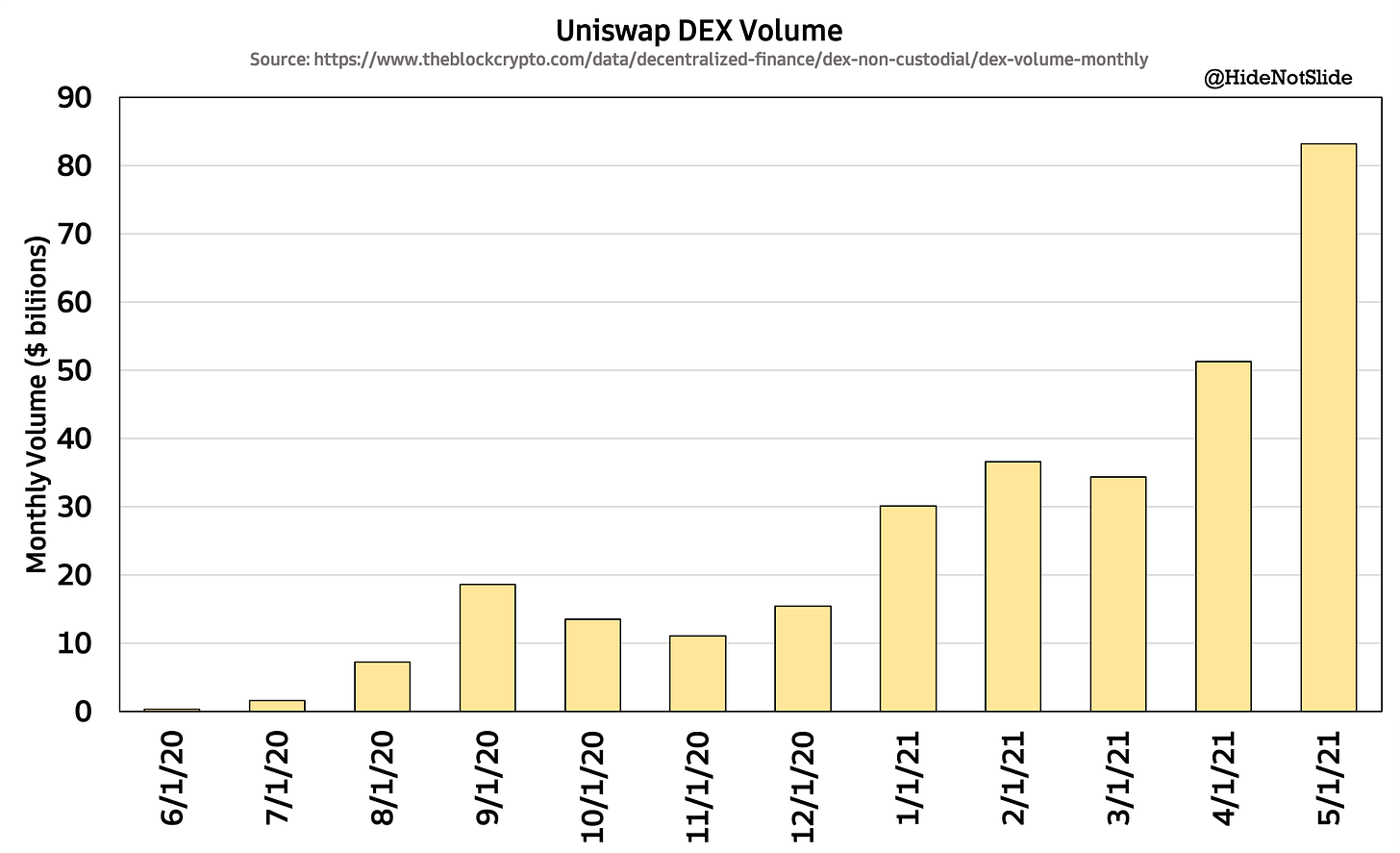

Chart of the Week

Remember Uniswap, the flagship decentralized crypto exchange I profiled in a post a few weeks back? They not only made new volume records last month - they smashed them. $83 billion in May volume nearly doubles April’s previous record, as DeFi interest compounds further & Uniswap v3 celebrates launch. DeFi Summer 2.0 may be heating up before our very eyes:

Thank you for reading this issue of Front Month. Word of mouth is the #1 way others find this newsletter - If you liked this week’s content, please consider sharing with friends & colleagues. Questions & feedback can be sent via email or Twitter.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, TW, NDAQ, COIN and VIRT. I am also long Bitcoin, Ethereum and Uniswap’s UNI governance token.