FTX + LedgerX: A Bigger Deal Than You Think

Plus: Gary strikes again, crypto market share, and more

Welcome to another issue of Front Month, a newsletter covering the biggest stories in exchanges & market structure every Friday. If you have questions or feedback, please reply to this email or find me on Twitter. If you like this newsletter and want to follow the exchange industry with me, please hit the Subscribe button below & be sure to share with friends & colleagues:

News

FTX.US Acquires LedgerX: The ever-changing, chaotic crypto market got another exciting update this week when FTX announced its deal to acquire LedgerX for an undisclosed sum. FTX was launched in May 2019 by Sam Bankman-Fried’s crypto trading firm Alameda Research and has since taken the industry by storm. FTX grew first as a non-US crypto derivatives exchange offering perpetual futures & tokenized assets to international traders. It popularized the allure & power of tokenized products like pre-IPO stocks, commodities like oil & even binary election futures. It officially entered the US in 2020 with the launch of FTX.US, a spot crypto exchange competing with the likes of Coinbase, Kraken, Gemini, and the vast field of smaller competitors.

To grow its brand & influence among retail traders FTX embarked on a massive marketing & sponsorship campaign, partnering with Major League Baseball, prominent eSports franchises, and even Tom Brady. The campaign has so far paid off in spades - FTX is now one of the largest spot crypto exchanges in the US, with daily volumes reaching ~$2 billion as of August 2021. That’s still about half of Coinbase, but it’s significant and growing quickly.

Now FTX owns LedgerX, which adds a whole new layer to its momentum & potential advantages in the US. LedgerX is a licensed derivatives exchange - it has a coveted green light from the CFTC to offer crypto derivatives to US clients. Buying this license gives FTX an effective work-around to the slow, costly regulatory process it would take to get a license of its own. Keep in mind - Coinbase, Kraken, Gemini & other spot exchanges do not have a license to trade crypto derivatives in the US. Additionally, CME (the largest US crypto derivatives exchange) does not offer spot crypto trading. FTX is the only exchange in the US that now offers both futures & spot trading, which it can use to build a competitive advantage & make its markets even more attractive.

For example - let’s think back to CME’s purchase of NEX in 2018. The strategic rationale for this $5.5 billion deal was the combination of fixed income futures - US Treasury, Eurodollar & Fed Funds - with NEX’s spot fixed income markets. Having both spot & futures products offered on the same platform would give customers margin savings & lead to better volumes & a deeper network effect at CME.

Shouldn’t the same thesis hold with FTX and LedgerX? If I’m a crypto trader looking to arbitrage Bitcoin futures against Bitcoin spot markets, I can either manage multiple cumbersome & dislocated positions on CME and Coinbase, or I can transfer all my money to FTX and trade them both in one place. In a market known for fragmentation, something like this can be a really powerful advantage. I’m quite excited to see how LedgerX evolves under FTX’s leadership - SBF continues to impress.

SEC Chairman Says Banning Payment for Order Is ‘On the Table’: More Gary Gensler interviews. More questions about payment for order flow. More industry-shaking comments that drive further debate among regulators & market participants. During an August 30 Barron’s interview Gensler again threatened today’s PFOF dynamics, this time focused on the “conflict of interest” among market makers in particular:

“They get the data, they get the first look, they get to match off buyers and sellers out of that order flow… that may not be the most efficient markets for the 2020s.”

We’ve covered this battle ad nauseam in previous posts, so I won’t bore you with the background. I will say, however, that Gensler’s claims of a wholesaler data advantage are puzzling to me. During the GameStop r/wallstreetbets heyday a variety of conspiracy theories surfaced about how Citadel was using data gathered from its wholesaling business to manipulate markets & separate retail traders from their money. There were plenty of other theories out there (the Citadel psych PhD rumor was one of my favorites) but they all shared one thing - they weren’t true.

To be clear - wholesalers do not have a data advantage. They make money by collecting the spread between a stock’s bid & asking price, and hedge away directional market exposure. When spreads are wide, they make more money. When spreads are tight, they make less. Special data associated with the order flow they receive has nothing to do with this practice. The only “advantage” wholesalers have is the privilege of executing against retail order flow, which they negotiate with & pay brokers for. Gensler’s comments imply his belief in something resembling one of these r/wallstreetbets theories - I need more explanation from him & his team at the SEC before I can understand his argument fully.

Fellow market structure enthusiast @drewg__ (who you should be following on Twitter if you aren’t already) said it best:

“The important thing to remember with PFOF is that firms are buying access to a desirable counterparty, not access to data.”

PayPal is exploring a stock-trading platform for U.S. customers: Robinhood completed its IPO in July 2021 to much fanfare & excitement about the retail broker space. User growth, trading volumes & sentiment were at all time highs, and the stock nearly doubled shortly after debut. Shares have since settled in a modest trading range slightly above its IPO price, but sank sharply on news that PayPal may soon become a new competitor.

This news highlights a tough reality - it’s really easy to start a retail brokerage in 2021. Any fintech platform that markets to retail customers can simply add trading to its product suite & take market share in an already crowded field. We’re seeing apps like Square, SoFi, StockTwits, and now Paypal launching trading functionality to capture some of the value Robinhood’s currently enjoying. The Paypal entrance is particularly concerning given its massive user base, eclipsing 400 million global users as of Q1 2021.

Between this, a calmer market environment, and intense regulatory pressure, I’m staying away from Robinhood and all competitors in the discount broker space at this time.

My latest paid post is live - My Clearinghouse Love Letter dives into the basics, the science, and the business of clearinghouses. These peculiar networks support the global economy & have been a major part of exchange industry success over the last decade. Subscribers get immediate access to this post and a long list of past research on the industry.

Thank you for your support!

Other Stories I’m Reading

ICE to launch micro MSCI index futures

Citadel operating chief in Asia departs for HKEX

Tradeweb Appoints Sara Furber As New Chief Financial Officer

Silicon Valley Exchange Lists First Two Companies in ESG Push

Abu Dhabi Securities Exchange (ADX) to Launch Derivatives Market, Leveraging Nasdaq Technology

CME Group and IHS Markit Complete Joint Venture and Launch OSTTRA, a New Post-Trade Services Company

Xi says China to set up Beijing stock exchange for SMEs

Chart of the Week

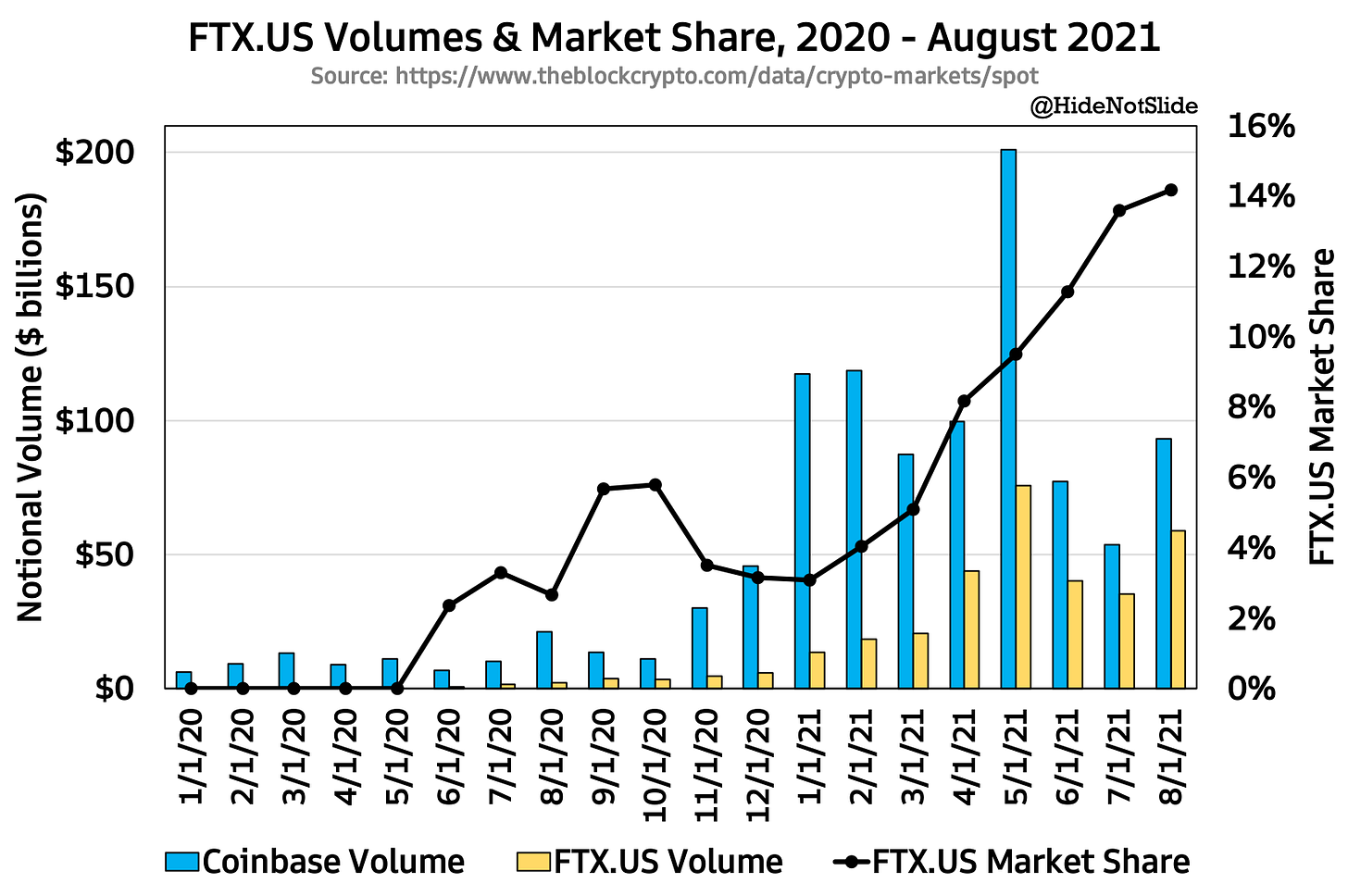

Let’s put FTX’s US momentum into context.

Below plots crypto exchange notional volumes by month for FTX.US and Coinbase from 2020 through August 2021. Coinbase is considered the top exchange in the US with ~20%-25% market share and ~$90 billion of traded notional in August. FTX.US has been around for just over a year but has already captured 14% of the US market as of August. My guess is market share will continue to creep up given the combo of marketing, a large social media presence by Bankman-Fried and other FTX execs, and LedgerX integration.

The question remains - when does FTX’s impressive rise affect Coinbase & its stock? I’ll have more thoughts on this in an upcoming post - stay tuned!

Thank you for reading this issue of Front Month. Word of mouth is the #1 way others find this newsletter - If you liked this week’s content, please consider sharing with friends & colleagues. Questions & feedback can be sent via email or Twitter.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, TW, NDAQ, COIN and VIRT. I am also long Solana.