Welcome to another issue of Front Month, a newsletter covering the biggest stories in exchanges every Friday. If you have questions or feedback, please reply to this email or find me on Twitter. If you like this newsletter and want to follow the exchange industry with me, please hit the Subscribe button below & be sure to share with friends & colleagues:

Francis Coppola’s 1972 film The Godfather is considered to be one of the greatest films ever made. It was the highest grossing film of all time for many years after release and won Academy Awards for Best Picture, Best Actor and Best Adapted Screenplay. The movie tells the story of the Corleone crime family shortly after World War II, when new business opportunities cause violent conflict among New York’s ruling mob bosses. As Michael Corleone (played by Al Pacino) succeeds his father as head of the family, he successfully avoids a dangerous new trade - narcotics - and expands into Las Vegas casinos to secure future power & wealth.

I recount The Godfather’s plot because an eerily similar dynamic is taking shape on Wall Street today. While certainly not as violent or felonious, our powerful financial institutions are jockeying to control a new lucrative & fast-growing trade - ESG investing. A structure is taking shape in coordination with exchanges, data providers & asset managers that closely resembles that of The Godfather’s five ruling families. The far-reaching impacts to investors & the market as a whole is worth serious examination.

It’s Just Good Business

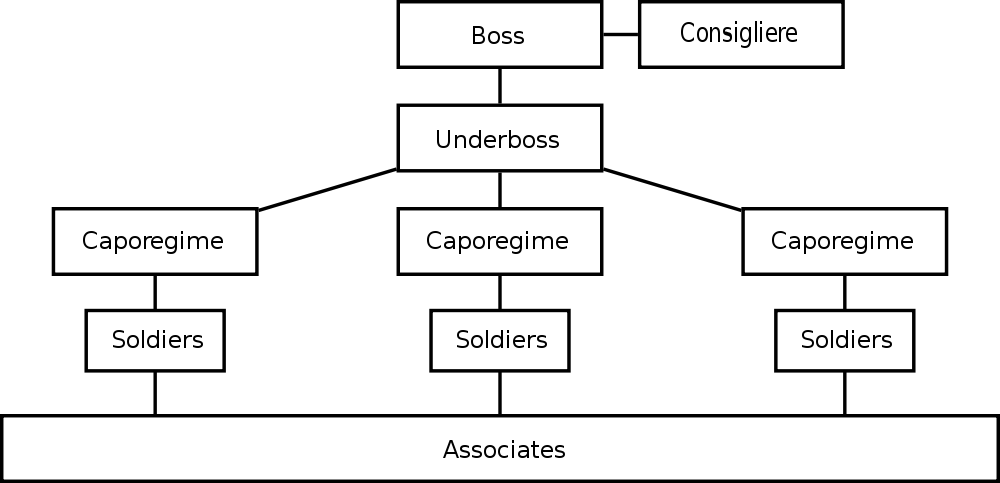

(Normal structure of a crime family. Source)

Every classic crime family begins with associates, the lowest level of an organization. While not considered part of the crime family itself, associates carry out the important & unsavory front-line work that keeps a criminal operation running smoothly. A successful mob boss needs an army of associates to back up influence with muscle.

In this analogy, associates in the ESG mafia are publicly-listed companies looking to improve their brand with pro-ESG policies. By now nearly all S&P 500 companies from Tesla to Exxon Mobil have a stated policy to improve the environment & corporate governance globally, and put a lot of effort into creating & broadcasting these policies to shareholders.

Why do they do this? Apart from a genuine desire to do good, well thought-out ESG policies serve two purposes - the first of which is improved brand perception. In its purest form, void of what-ifs and ulterior motives, no one is against improving the environment. Finding a level of common ground with shareholders & showing they own a company focused on doing good is a low risk endeavor.

The second reason companies publish pro-ESG rhetoric is to avoid punishment from the mafia’s next level - soldiers. Soldiers are officially a part of the family, and are considered “made men” - attacks against them are off-limits and met with swift retaliation. Rating agencies including S&P and Moody’s are the closest resemblance to soldiers in the ESG mafia. If a listed company lacks a coherent ESG policy and doesn’t take necessary steps to execute against this policy, they risk receiving an unfavorable ESG rating, threatening that positive brand perception they worked so hard to build. Additional pressures may follow a poor ESG rating, including shareholder complaints & even political & regulatory action. In many ways, rating agencies are making companies an offer they can’t refuse when incorporating ESG into their evaluation process. Either meet their criteria & receive public praise or risk bad PR and the associated fallout effects of exclusion from the ESG club. Oh, and don’t forget ESG ratings come with extra one-time and recurring fees.

As we move up the chain of command, we arrive at a small group of companies that stand to benefit greatly from the rise of ESG - stock exchanges. Exchanges are the ESG mafia’s capos, able to wield influence & collect significant profits while avoiding front-line work left to associates & soldiers. NYSE and Nasdaq in particular have a unique tool to grow the ESG pie - listing standards. Nasdaq recently proposed new standards requiring companies to have at least one female director and one minority or LGBT director on their board. Senate Republicans are trying to block the proposal, calling it an abuse of the exchange’s authority. Because IPOs are an effective duopoly in the US, these two exchanges have unique opportunities to pressure nearly every domestic public company.

Apart from applying pressure, exchanges extract fees from the growth of ESG via new market data products that help clients comply with new regulations & form new investing strategies. ICE is beefing up its reference data with dozens of new ESG metrics & screening tools. Nasdaq added an ESG data aggregation service to its platform in early 2020. There’s also the plethora of ESG bonds, futures contracts & ETFs that are coming to market, generating valuable proprietary data that can be streamed to clients at added cost. Nearly every exchange has launched some sort of flagship ESG trading product in the last year:

Deutsche Borse - STOXX ESG-X Futures

CBOE - S&P 500 ESG Index Options

Euronext - Eurozone ESG Index Futures

LSE - ESG Credit Default Swaps

MarketAxess - Green Bonds

Tradeweb - Green Bonds

As these markets grow in size & stature, traders will be forced to incorporate these products into their portfolio, paying added fees to do so.

Next in the hierarchy is the underboss, as close to the top of a crime family as possible without carrying the official “Don” label. The ESG mafia’s underbosses are the index providers, the largest of which are MSCI, FTSE Russell and S&P Dow Jones Indices. Index providers own the benchmarks that form the bedrock of ESG investing, and have the power to add & remove companies from these benchmarks at will. As more assets pour into funds that track these ESG indices, the power of index providers grows in direct proportion. Research has argued stocks exhibit material index inclusion effects where returns move upward after a company is included in a large equity benchmark. Index providers act as gatekeepers to these benefits, and the inclusion process is described as more political than algorithmic.

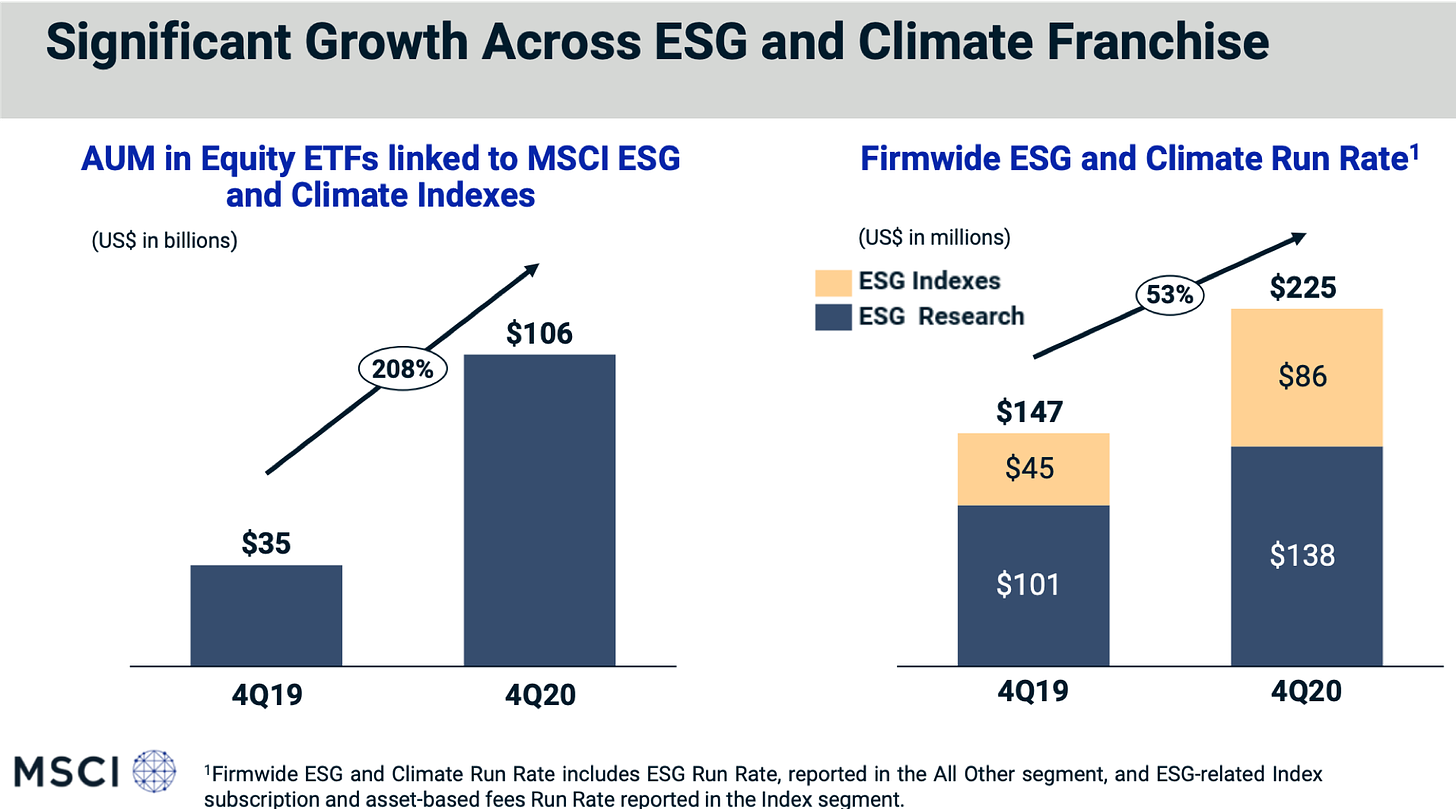

From a fee perspective, index providers enjoy compounding benefits as money from associates, soldiers & capos flows up the pyramid into the underboss’s coffer. Listed companies pay ratings agencies & exchanges for ESG data, who then pass some fees on to the index providers. This compounding accelerated in 2020 - MSCI in particular saw its ESG & Climate annual recurring revenue grow +53% in Q4 2020:

(Source)

Finally, we arrive at the boss. The head of the family. The primary source of pressure & beneficiary of the ESG phenomenon. It likely won’t come as a surprise by now - BlackRock is the unequivocal boss of the ESG mafia. First, with nearly $9 trillion in assets under management, BlackRock is massive. They’re the top 1 or 2 shareholder at nearly every company in the S&P 500, and the nuances of passive investing give BlackRock control over the voting rights of their massive holdings. Amusingly, BlackRock even owns 6% of itself through client equity ETF holdings. Second, BlackRock has extensive political connections, with high-profile alumni at the US Treasury, the National Economic Council, and serving as economic advisors to President Joe Biden & VP Kamala Harris. Third, the flow of profits from lower levels of the family ends at BlackRock’s doorstep - new indices, trading products & interest in ESG end with more AUM in ESG funds where BlackRock takes a hefty cut.

Every boss has a consigliere, an advisor helping direct the boss’s focus & power effectively. BlackRock is no different - an internal team of ~45 serves as BlackRock’s Investment Stewardship team, tasked with engaging company boards & recommending how to vote the shares of their massive equity portfolio.

(Source)

In 2020, BlackRock woke up to the massive power they wield as the world’s top investor, and began putting that power to work more aggressively in support of an ESG agenda. Engagements with company boards grew by +48% YoY, with over a third of them involving votes against management. This increasingly engaged voting presence comes with CEO Larry Fink’s annual letter calling for more companies to focus on climate change, sustainability & saving the environment. This isn’t so much a suggestion as it is a threat for managers to either get in line with BlackRock’s ESG focus or get voted out of a job. With this kind of influence, the world’s largest asset manager is the boss for a reason.

As the ESG mafia’s structure comes into clearer view, let’s not forget why this shift is taking place with such speed & force. According to a recent Deloitte study, ESG-mandated assets could make up 50% of total AUM by 2025. Annual ESG market data spend is expected to eclipse $1 billion globally by 2021, growing at a +20% annual clip. Asset managers, index providers, rating agencies & exchanges all are preparing for the coming ESG investing wave brought on by an aging millennial population. ESG is, at its core, a marketing tactic. Younger investors who care about the environment and social change will be more comfortable working with Wall Street if they believe Wall Street’s fighting for that change too.

Whether ESG investing will actually bring about the change millennials want is a conversation for a future post. Regardless, the ESG mafia is working hard to ensure it always gets its cut.

Honorable Mentions

Coinbase released its S-1 on 2/25 to much fanfare & investor interest. The company is expecting to go public in the coming months at anywhere from a $70-$100 billion valuation, more than where most other public exchanges are trading.

Apex Clearing, a large clearing broker supporting trading apps like Stocktwits, WeBull & Public, announced it will be going public via SPAC at a nearly $5 billion valuation.

With rising inflation expectations causing a recent spike in yields, CME reported record volumes in its Ultra 10-Year Note & 30-Year Bond Futures products on 2/23. The stock is markedly outperforming the S&P year to date on an improving macro setup for the company, along with recent analyst upgrades of the stock.

Chart of the Week

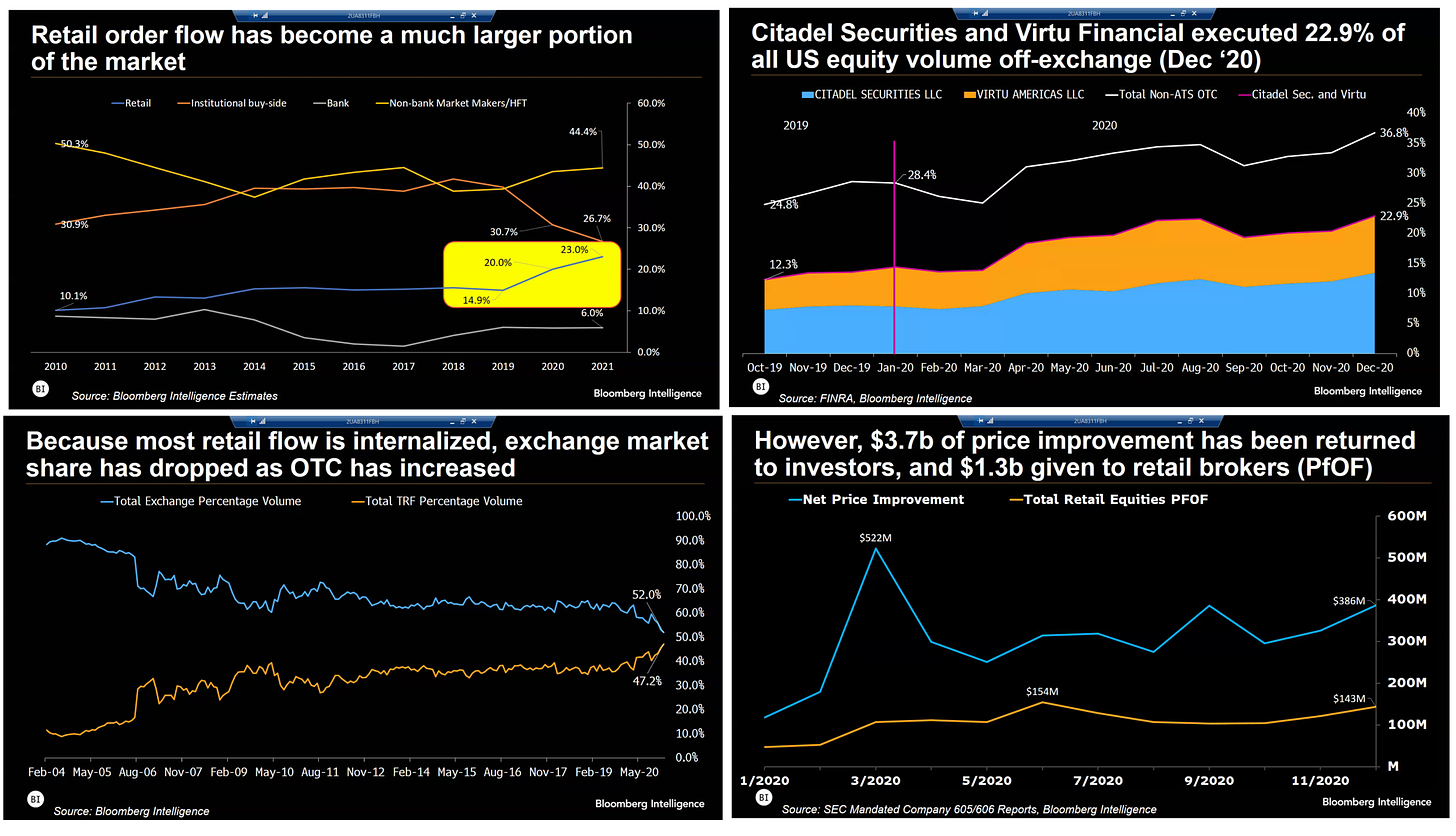

On 2/24 Bloomberg’s head of market structure research Larry Tabb hosted a live call with Virtu CEO Doug Cifu, where they discussed the rise of retail trading in the equity markets, payment for order flow, and the challenges of market-making during the chaos. I highly recommend going back and watching the interview - it was very informative & easy to understand. You can find a playback here.

Below are some interesting charts shown during the presentation - examining the surge in retail order flow, Citadel & Virtu market share, off-exchange trading, and price-improvement vs. PFOF:

Thank you for reading this issue of Front Month. Word of mouth is the #1 way others find this newsletter - If you liked this week’s content, please consider sharing with friends & colleagues. Questions & feedback can be sent via email or Twitter.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, TW, NDAQ and VIRT. I am also long Bitcoin.