Welcome to another issue of Front Month, a newsletter covering the biggest stories in exchanges & market structure every Friday. If you have questions or feedback, please reply to this email or find me on Twitter. If you like this newsletter and want to follow the exchange industry with me, please hit the Subscribe button below & be sure to share with friends & colleagues:

2020 was a weird & transformative year for me.

Like many others, I was stuck at home during COVID lockdown & had quite a bit of time on my hands. I did a lot of Twitter lurking for my financial news & the occasional meme, but no tweeting of my own. I had also recently changed jobs & left an industry that utterly fascinated me - the world of exchanges & market structure. So many interesting stories were playing out in the space & there was so much to learn. I loved following different rabbit holes of the industry’s history & evolving impact on global finance, and learning how to understand & value the handful of stocks that dominated the sector.

The more I learned about exchanges the more I realized how barely anyone outside of the industry seemed to talk about them. The top institutions paid for sell-side research & there was an occasional write-up of an exchange here or there, but nothing existed that gave the industry the spotlight I thought it deserved.

My convictions about how under-followed the industry was only grew as time went on. To stay on top of the news I used an elaborate web of RSS feeds, Google Alerts & pre-filtered Twitter searches to collect updates. I would then spend a considerable amount of time interpreting the news, discarding the stories that weren’t important & adding depth to the stories that were. What does that term mean again? How does this relate? Who’s being interviewed? What’s their story? Does this impact the stock?

As I honed this filtering & interpreting process, a thought kept crossing my mind: I can’t be the only one struggling with this. Why doesn’t a service exist that collects & explains the exchange stories that matter?

Instead of waiting for a service like this to pop up, I decided to try and form one myself. I became active on Twitter as an exchange-focused account in late May of 2020. I shared links to news & research I thought was worth reading, and tried to translate the headlines into insight most investors could understand. I also wrote some initial write-ups of the main exchange stocks for Seeking Alpha, highlighting the industry catalysts I thought were being overlooked.

Reader engagement was slow going at first, but as I kept sharing the stories & headlines I thought were worth attention, a community started to form. Many different types of investors started reaching out & engaging with my research, including current & former exchange employees, investment funds with exchange stocks in their portfolio, and everyday retail investors. I recognized there was a shared interest among them all - easy to read, understandable analysis of an industry known for complexity. I became one of the only accounts on Twitter with this focus - helping investors become smarter & more informed about exchanges and market structure.

As the community evolved, so too did my research. I launched this Substack in October 2020 as a deeper, long-form extension of what I was sharing on Twitter. I wanted to spend more time on a topic than what could fit in a couple tweets and keep the output in an organized space. I thought maybe a few people would find it valuable like I did.

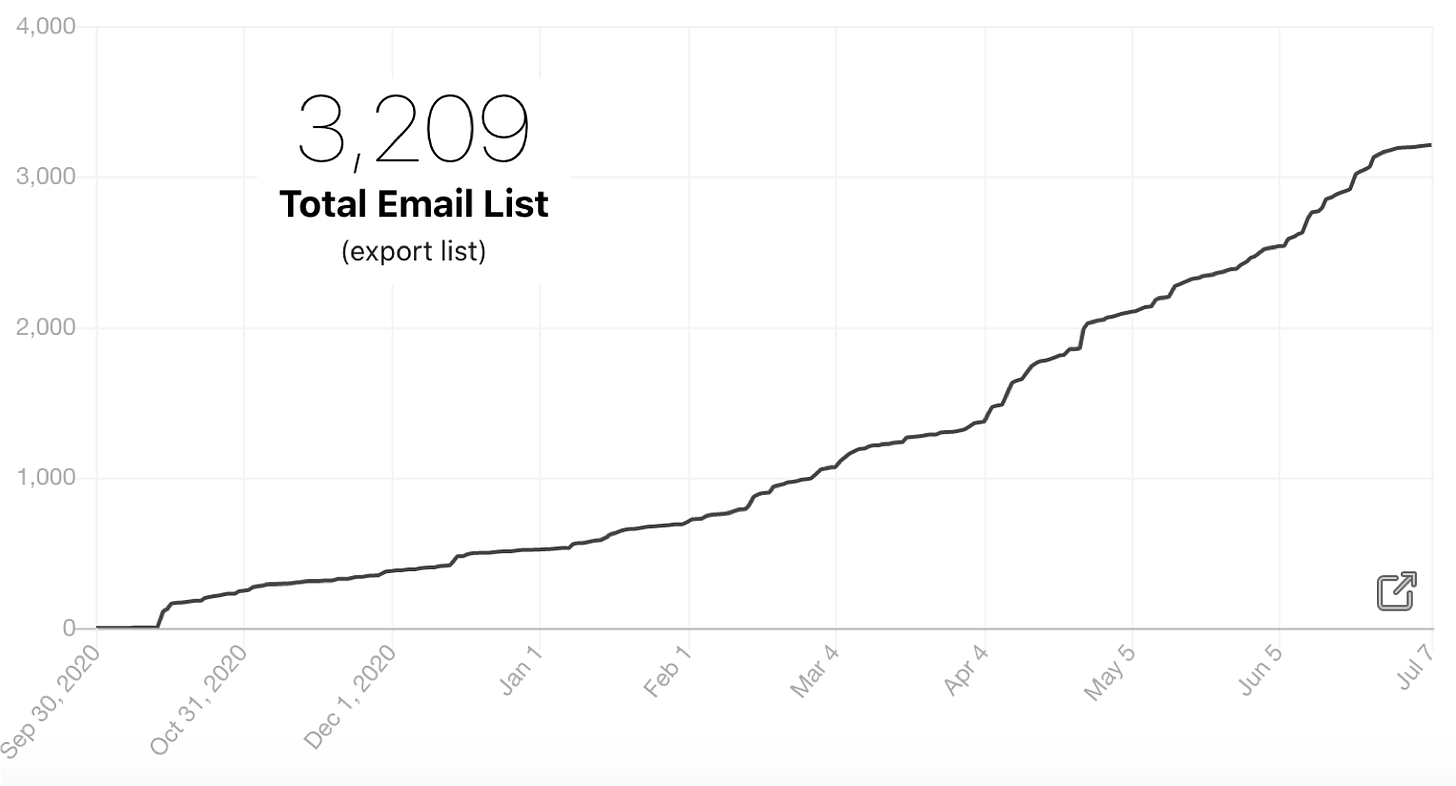

Nine months, 36 posts and more than 100,000 views later, and the response has surpassed all expectations. There are now more than 3,200 of you who’ve shown interest in exchanges & market structure since I’ve started:

Here are some of the top posts we’ve discussed:

A deep dive into an exchange’s largest customer base - high frequency trading firms, including DRW, Susquehanna, Jump Trading & Jane Street.

A study of crypto market structure players like Coinbase, Uniswap, and Binance.

Full coverage of exchange earnings season each quarter, including winners, losers & the stocks I’m watching.

I’ve deeply enjoyed the research I’ve been able to do & the incredibly smart people I’ve been able to meet as a result of this public work. I want to keep up this routine of research & public writing for as long as I possibly can.

It’s because of this desire to build a sustainable, long-term routine of exchange & market structure research that I want to make a couple important changes to this newsletter going forward.

First, today I’m adding a paid tier to this newsletter starting at $249 per year. This tier will begin with two extra posts per month that will ramp up over time as I get into a new writing rhythm. The first two posts are already live - OMX: The Deal That Defined Nasdaq and My Robinhood Gameplan.

I know there are new paid Substacks popping up every day now, especially in the finance/investing arena. However I truly believe I am the only writer on this platform with a specific focus on exchanges & market structure. This focus will only become sharper as my writing continues.

Here are some of the research topics coming soon to the paid tier:

More studies of high frequency trading firms including Optiver, IMC, Ronin, Flow Traders, and Citadel Securities.

Overviews of exchange-adjacent industries like discount brokers, asset managers & more niche market data firms.

In-depth earnings analysis & research behind the exchange stocks I own and those I’m avoiding.

The potential for interviews with industry executives & investors down the road.

If you choose to sign up for this tier before August 1, 2021, you can get 20% off the annual price via the below link. For corporate accounts interested in bulk subscriptions, please reach out to me directly for details.

Second, the format of my free weekly posts will return to recapping & explaining industry news rather than long-form deep dives on a topic. I’ve slowly moved away from this as the deeper stories take more of my time, but I really want to come back to it. I personally get a lot of value out of an industry news curation & interpretation service like this & I think readers will find it valuable as well.

I hope you’ll join me as I continue to research & write about exchanges to the best of my ability. Whether you decide to join the paid tier or not, I genuinely appreciate your interest & support of this newsletter. Please feel free to send me an email or Twitter DM with any questions.

Front Month’s next chapter begins now!

Thank you for reading this issue of Front Month. Word of mouth is the #1 way others find this newsletter - If you liked this week’s content, please consider sharing with friends & colleagues. Questions & feedback can be sent via email or Twitter.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, TW, NDAQ, COIN and VIRT. I am also long Bitcoin, Ethereum and Uniswap’s UNI governance token. This newsletter is the wholly owned property of Front Month Research, LLC.