I would’ve paid a lot of money to be a fly on the wall when Adam Neumann pitched a16z and Samsung on his new blockchain carbon startup, Flowcarbon. Here’s how I imagine the conversation went:

“Hello a16z and Samsung executives. Thank you for coming to my pitch today.

My name is Adam Neumann, but you probably already knew that. I founded this

real estatetech company called WeWork in 2008, and although it ended up failing spectacularly only three years ago, we had an incredible run and made quite a bit of money for our early investors who sold before it all came crashing down.I've done a great deal of soul searching in the years since my departure from WeWork, which has led me to my next venture, called Flowcarbon.

If you give me $70 million of capital, I will build one of the most valuable blockchain carbon protocols the world has ever known and make you all more rich than you already are.

Thank you again.”

Imagine the conversation & laugh about it all you want - the fact that Adam Neumann did receive so much money from these high profile investors won’t change.

The more I thought about it, the more this story utterly baffled me. How in the world can a well-known fairy tale-peddling grifter like Adam Neumann return to the markets & raise many millions of dollars so quickly? Do people really think Neumann became a trustworthy visionary in a flavor-of-the-month field like crypto AND carbon markets in such a short amount of time? What am I missing here?

I believe many signals are embedded within Flowcarbon’s eye-catching fundraise. One could be yet another late stage example of low interest rates and easy money gone wild. Another could be the desperation of crypto VCs to find returns during a vicious bear market. The signal that I find the most intriguing, however, is this - carbon markets are now becoming mainstream, and could very well be a target of the next speculative memetic frenzy.

If this signal proves accurate it’ll come with wide-ranging impacts to the key pillars of the carbon industry - companies actively trading carbon today, institutions working to build liquidity in the space, and of course, many of the world’s top exchanges. Above all others, exchanges lie at the center of the global carbon market, and have much to gain from its entrance onto the world stage.

In this post I want to give investors a crash course in carbon market structure through the lens of exchanges. Carbon is an extremely opaque asset class, operates under very little regulation, and is rife with grifters & speculative mania, but investors can still find ways to profit from the market’s legitimate growth. I believe exchanges are currently the best tool to both understand how carbon markets work today & profit from their evolution moving forward.

Carbon 101

Carbon markets are built on the simple idea that free markets and governments can work together to solve problems. Imagine you’re in charge of a large, developed nation’s environmental agenda. Your increasingly climate-conscious constituents want to see action from your department - aggressive targets need to be set & real progress made over time if you want to stay in office. On the other side of the aisle, the business community, while slowly leaning more climate-conscious as well, have fiduciary duties to their shareholders & must do whatever they can to combat competition & remain profitable. How should your government fulfill its climate goals in an effective but efficient & business-friendly way?

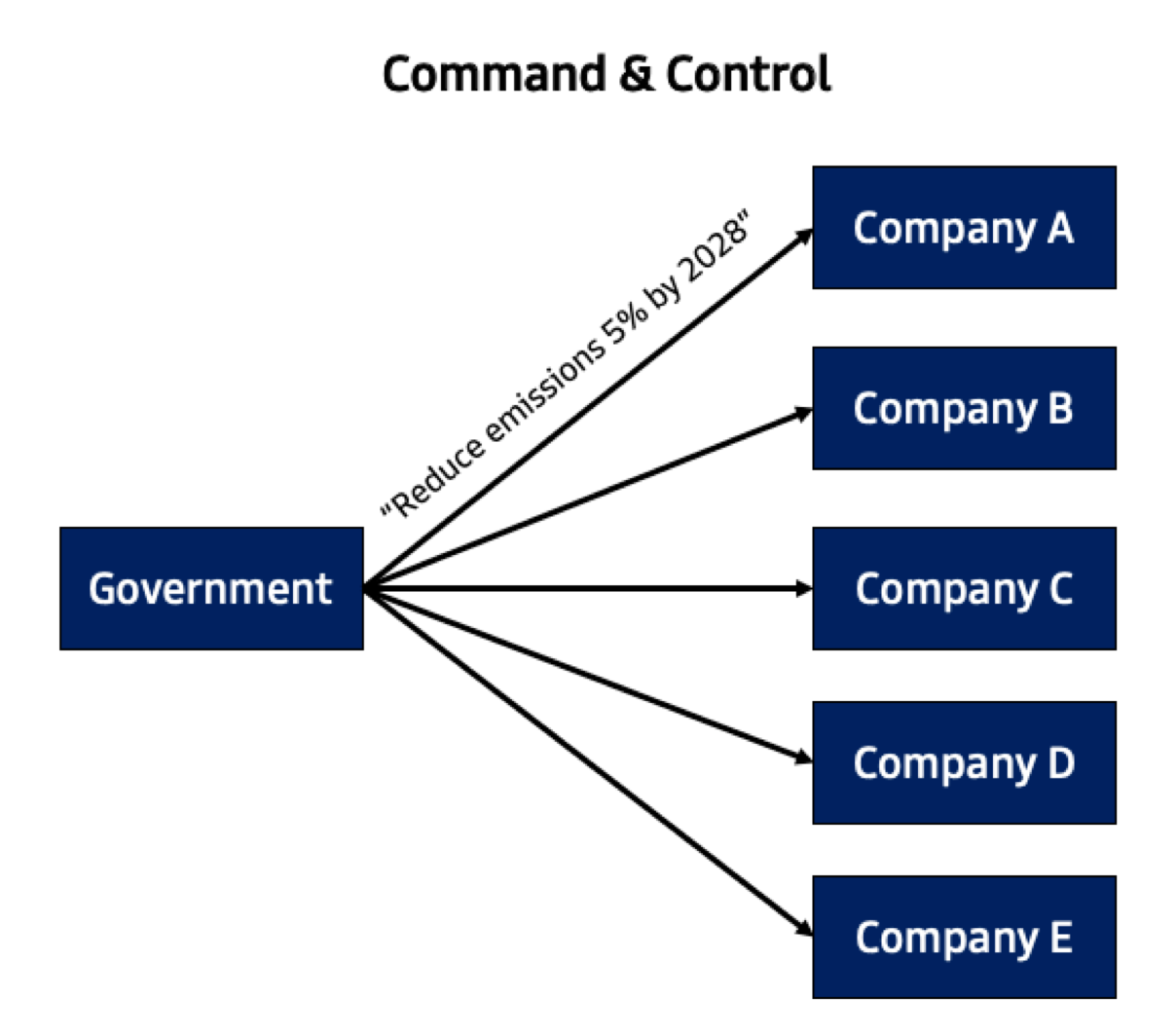

One approach is to prioritize real, measurable greenhouse gas reductions above all else, putting the needs of your constituents above the nuanced needs of your economy. This is called command and control regulation - handing out company or industry-specific greenhouse gas reduction targets & requiring companies to comply regardless of the cost. In command and control climate regimes, many companies find their targets impossible to hit, requiring a technical overhaul that would exhaust valuable financial resources or make the firm uncompetitive. Negotiating exemptions or leaving the country altogether are the only realistic solutions these companies have, hurting economic growth & doing little to help the environment. While effective in certain industries or situations, command and control regulation normally doesn’t lead to the best environmental results.

There is a second approach to consider, one that’s proven a drastically superior way to reach climate targets in partnership with the business community.

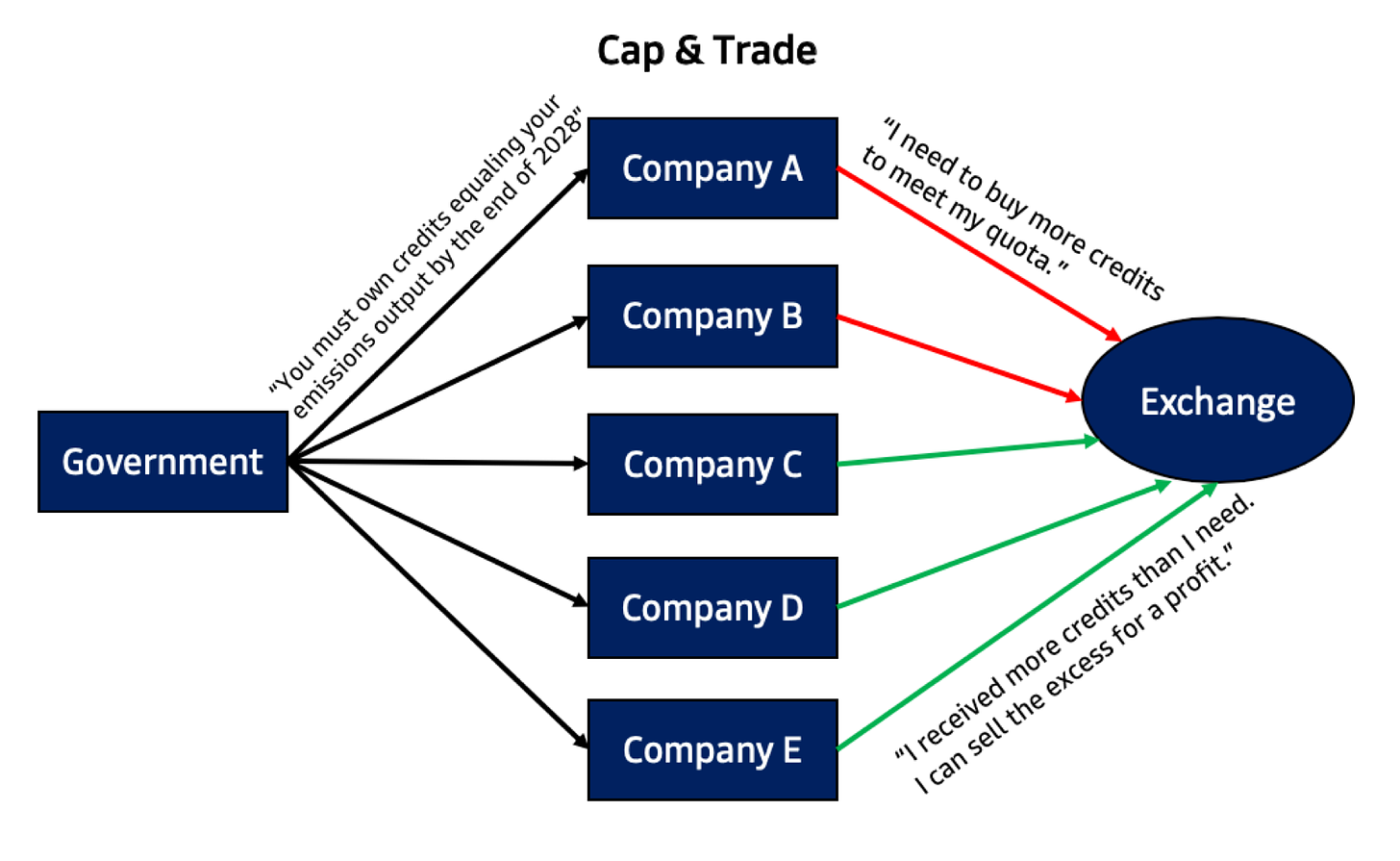

In this scenario, the government creates a virtual voucher called a carbon credit & allocates these credits among the companies it seeks to regulate. Companies can only emit greenhouse gases if they have enough matching credits, and can trade with other companies to acquire credits if needed. This is called cap and trade regulation, blending government intervention with free market economics to achieve a more efficient environmental outcome.

Each year the government reduces the amount of credits it allocates across the industry, requiring emissions to go down in the aggregate and letting the free market decide where those reductions come from. If one company is allocated more credits than it needs, it can sell its surplus into the marketplace and be financially rewarded for exceeding government targets. Others that have a harder time reducing emissions must pay up for credits to stay in compliance, balancing the cost of each credit with investments needed to improve its carbon footprint. As climate change becomes a more important part of global policy, governments are increasingly using cap and trade tactics to accomplish their goals, with impressive effect.

Exchanges - Mostly ICE - At The Center

Cap & trade regulation cannot exist without trading, and trading cannot take place without an exchange. As cap & trade has evolved since its creation in the 1960s the tools exchanges provide to support the carbon market have evolved with it. Exchanges operate the initial auction of carbon credits when they’re allocated to companies. They maintain an orderly spot market and support carbon clearing & settlement. Exchanges offer carbon hedging mechanisms through a diverse set of futures products. They clean & distribute its market data. At nearly every point in the market’s lifecycle exchanges step in to make sure liquid trading in carbon can take place, and are just now starting to see serious return on their investment.

No exchange better highlights how far carbon markets have come than ICE, who I believe is also the best positioned exchange to benefit from further adoption of the asset class. In 2010 ICE announced a deal to buy the Climate Exchange, one of the largest carbon credit trading platforms in the world with 80% market share in Europe and smaller growth markets in the US and Asia.

At the time ICE’s $600 million purchase was seen as a risky one. The Climate Exchange was not profitable when it was acquired, carbon trading volumes had contracted after the 2008 financial crisis, and uncertainty remained about how climate regulation would evolve outside of Europe. Had ICE overpaid for exposure to a premature market with limited upside & no real path to sustained profits?

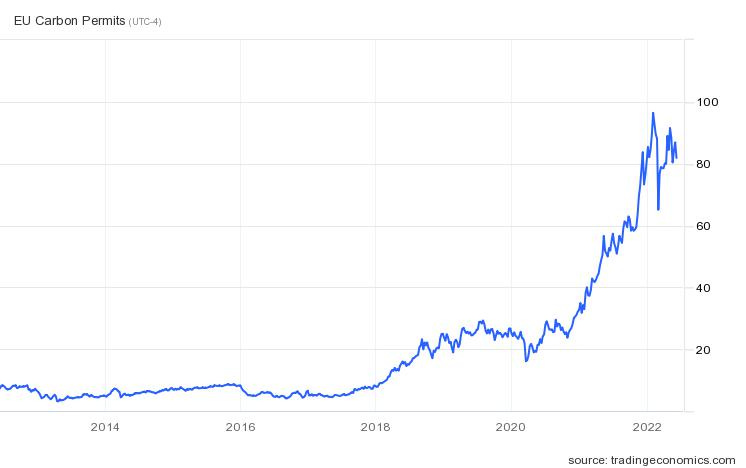

12 years later ICE’s carbon futures stand out as one of its fastest growing markets. In 2021 ICE environmental revenue hit a record $120 million after growing nearly +60% YoY. European carbon prices have exploded higher since COVID and US carbon trading programs are beginning to build serious momentum, leading to record demand for ICE’s futures products. A seemingly pricey acquisition by ICE over a decade ago has positioned the exchange to enjoy incredible returns in the post-COVID, climate-conscious era:

Moving forward I see two catalysts that should lead to more records for ICE’s carbon business. First, climate change regulation across the globe has only intensified in recent years as Western governments seek to clamp down on fossil fuel consumption & lower global emissions output. The effects of these policies are starting to show up in energy inflation data as gas prices eclipse $5.00 per gallon in the US, but they also directly affect the price of carbon. As long as environmentally-focused leaders continue to dominate Western politics, carbon prices & trading volumes should remain strong.

Second, new products that give everyday investors access to carbon are only just starting to hit the market. In July 2020 KraneShares launched what is now the world’s largest carbon ETF that seeks to track a series of global carbon price benchmarks. The fund has amassed over $1.2 billion in AUM and tracks its benchmark by buying & continuously rolling thousands of ICE carbon futures contracts. As more money flows into KraneShares carbon products - from institutions, retail investors, or a combination of the two - we should see ICE carbon volumes & transaction fees rise in tandem.

The Dark Side Of Carbon

The examples I’ve given to describe the carbon market up to this point have been pretty clear & simple. Government-sponsored emission reduction programs with legitimate exchange support represent the safest, cleanest version of the carbon industry. There exists a darker, murkier corner of the market that we can’t finish this post without addressing.

Carbon trading exhibits many of the same qualities as its sister theme, ESG. Both involve good intentions, government pressure, unclear definitions, billions of dollars in Wall Street funding and a deep bench of bad actors waiting to capitalize on unsuspecting investors. I fear both themes are heading for a similar fate - a fate where investors fall prey to grifters and environmental change doesn’t happen as regulators sit idly by.

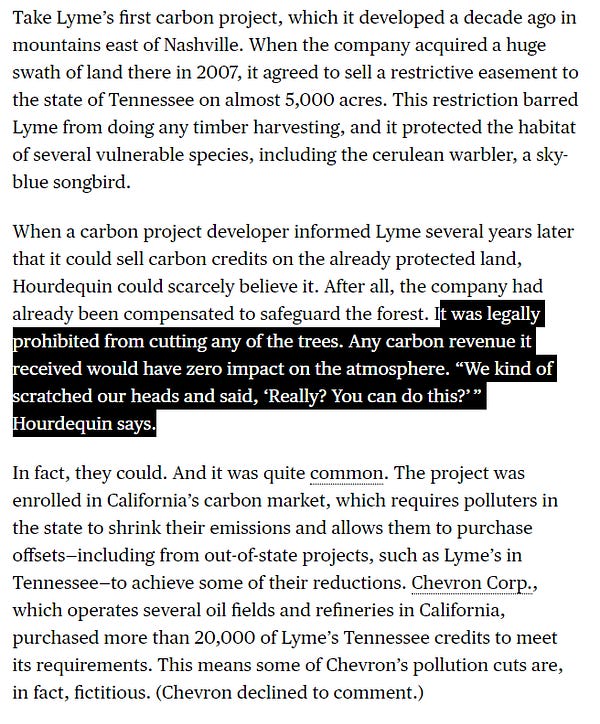

For example - the WSJ recently reported on the carbon gold rush currently raging in the Canadian stock market as companies race to raise money & invest in carbon credit projects. Many of these projects don’t actually reduce greenhouse gas emissions, but are simply established initiatives looking to cash in on the carbon hype. Buying these kinds of credits may put companies in compliance with government programs, but are they really doing what policymakers want?

Another, more clear-cut example of wasteful carbon trading was highlighted by Bloomberg’s Joe Weisenthal a few months ago - his tweet on the topic speaks for itself:

This brings us to the creme de la creme narrative, the 200 IQ startup idea, the peak thesis that will have VCs salivating before you can finish your pitch - carbon credit trading, on the blockchain.

The idea behind a carbon-crypto partnership is straightforward enough - blockchain technology could help add transparency to the market, improve spot market liquidity, and let regulators track when & how credits are created and retired. This is the idea Adam Neumann is pitching to investors today, and the same idea a company called Toucan launched with in 2020. Since its launch Toucan has shown that the major effect crypto exchanges have had on the carbon market has been to give projects that don’t need money access to unnecessary funding. Like in Canada, an influx of capital into Toucan’s carbon trading platform have brought traders & companies out of the woodwork to meet the demand, whether they have useful projects to sell or not. The owners of these projects may think they’re doing the environment & investors a service by taking their money. I stand on the cynical side of that debate.

If carbon markets begin to attract serious mainstream interest from investment funds or retail traders, we could see the price of carbon continue to march higher in the months to come. Instead of chasing the hype & trying to time a bubble, I’m betting on the exchanges that are positioned to turn a carbon boom into serious trading & market data profits.

Thank you for reading this issue of Front Month! If you’d like to read more of my market structure research & support my work, please check out my archive on Gumroad with over 20 articles & supporting financial models for the exchange industry. Please reply to this email or DM me on Twitter with any questions.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, TW, SPGI, NDAQ and VIRT. I am also long LOOKS and SOL.