Welcome to another issue of Front Month, a newsletter covering the biggest stories in exchanges & market structure every Friday. If you have questions or feedback, please reply to this email or find me on Twitter. If you like this newsletter and want to follow the exchange industry with me, please hit the Subscribe button below & be sure to share with friends & colleagues:

Remember earnings season this time last year?

It seems like decades ago now. By the end of Q1 2020, the world had entered the darkest depths of COVID lockdown, equity markets had suffered the fastest bear market on record, and we had no idea what the future held. For maybe the first time ever, management teams were beginning their prepared remarks by listing the steps they were taking to keep employees safe during the quarter, rather than ways their business grew earnings. Corporate & investor fear was palpable.

Fast forward to today. The world arguably could not be farther from last year's reality - markets have screamed past all-time highs, consumer sentiment is back to pre-COVID levels, and markets are worried about inflation rather than deflation.

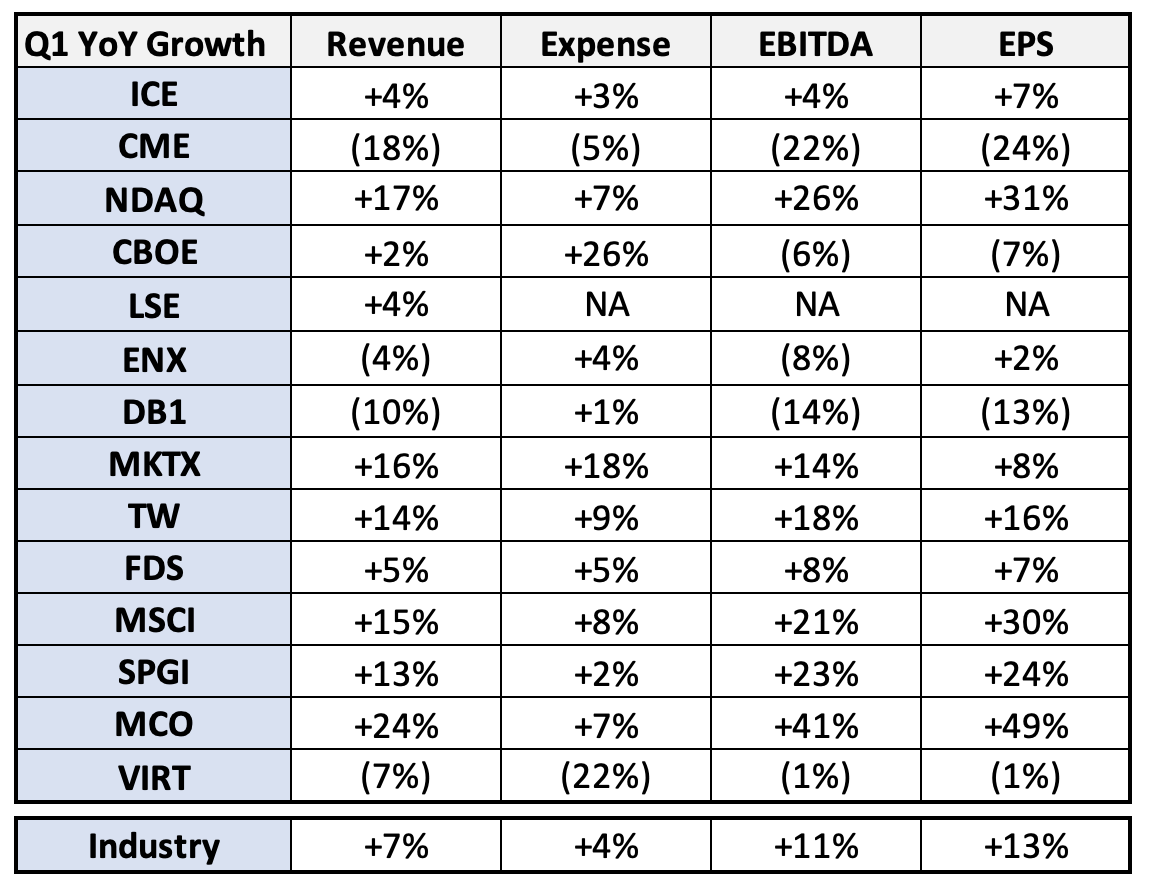

I say all this to set the stage for a truly killer earnings season among the exchange & market data industry this quarter. The average company in the sector grew EBITDA and earnings by double digits against a 2020 comparison that included historic levels of volatility & uncertainty. Returns across the sector have impressed as well - most exchange & market data stocks are outperforming the S&P 500 year-to-date. Exchange investors should come out of this earnings season with smiles on their faces & excited about the industry’s future.

I want to spend the rest of this post diving into the companies that both impressed & underwhelmed me the most. Did any reports cause me to change my mind about a particular stock or story? Did any themes emerge among management’s commentary investors need to be aware of? I’ll try to answer these questions and more below.

Before diving in, I recommend you check out my free 2021 exchange & market data guide if you haven’t already done so. The report will help give you context for the themes underpinning each exchange stock this year & my thoughts on the industry as a whole.

(Source)

Q1 2021 Industry Winners

#1: S&P Global and Moody’s

Throughout 2020 the story of note among the world’s top two credit rating agencies was the unbelievable pace of global debt issuance in the wake of COVID-19. As corporations & governments took advantage of low interest rates to strengthen their balance sheets & refinance existing debt, demand for credit ratings exploded. S&P Global & Moody’s issued conservative guidance to begin 2020 and spent every quarter thereafter raising their outlook as issuance kept pouring in. By the end of 2020, global debt issuance had crushed all previous records and ratings agencies had enjoyed their best sales results in decades.

As 2021 came into view, we’d expect growth to slow down as both companies run into difficult year-over-year comparisons, right? Both S&P Global and Moody’s gave guidance supporting such a view.

Wrong. Both companies reported stellar growth in revenue & EPS once again driven by another blowout quarter for ratings demand. The interesting shift here is that growth is now being supported by high yield debt issuance instead of investment grade. Both S&P Global and Moody’s saw high yield issuance nearly double YoY as a surge in SPAC launches & the market’s frantic search for yield sent money into the junk market at a pace not seen since the late 90s.

While I do think the blistering pace of HY issuance will slow down, I don’t think it will hurt the stocks of both rating agencies this year. S&P Global’s dominant Dow Jones Indices business is riding a strong equity market to record revenues, and both companies own ESG market data services that are positioned well for a secular rise in sustainable investing interest.

I think both stocks trade at okay valuations today, and I’m kicking myself for not buying either one earlier this year.

#2: Tradeweb

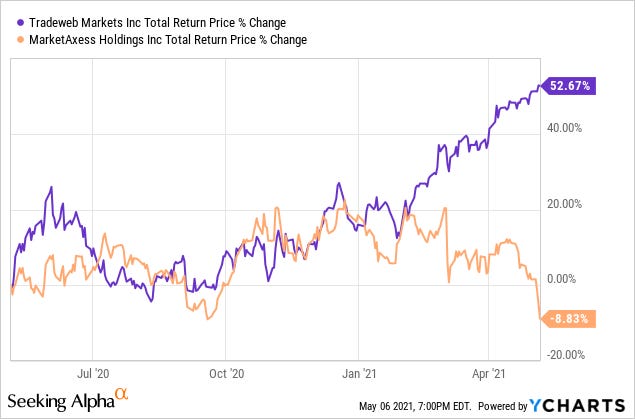

A pretty stunning divergence has emerged this year. Two stocks that normally trade in lockstep with each other began separating significantly in February 2021. MarketAxess has underperformed the S&P 500 by a whopping 35% while Tradeweb has ripped higher & hasn’t looked back:

Why has Tradeweb performed so well while its closest rival has lagged? I believe the answer is two-fold:

Optimism about Tradeweb’s US Treasuries volume as inflation rises

Impressive growth in electronic market share outside of rates, particularly in corporate bonds

The first point is largely a macro story - as inflation expectations rise, markets begin to price in a response from the Fed via higher interest rates. Higher rates consistently lead to strong trading volumes in related products, as participants manage volatility in a market no longer kept artificially muffled by government policy. In Q1 2021 Tradeweb reported impressive +22% growth in US Treasuries volume compared to a strong quarter last year. The macro dynamic is a powerful influence on Tradeweb’s largest market, a dynamic we saw in full force this quarter.

The second point connects back to Tradeweb’s next largest product group - credit, comprised of CDS trading, municipal bonds, Chinese fixed income, and US corporate bonds. MarketAxess has always been the top dog in electronic corporate bonds, but I think the market is waking up to Tradeweb’s role as the serious #2 exchange and tough competitor in the space. In 2017, Tradeweb’s electronic market share in corporate bonds stood at 2% while MarketAxess stood at 15%. By March 2021, Tradeweb’s share stood at 10% compared to MarketAxess’s 20%. Tradeweb is still clearly the #2 corporate bond exchange, but it’s quickly catching up. Credit has accounted for the majority of Tradeweb’s revenue growth for four consecutive quarters & now makes up nearly 30% of the business.

I believe the market is rewarding Tradeweb for its success in non-rates products and is the main reason I continue to hold the stock. I’m also excited for the addition of eSpeed later this year as they look to compete with BrokerTec in the D2D Treasuries market.

#3: Virtu Financial

Most seasoned investors & followers of the stock will tell you that Virtu is a notoriously difficult company to value. The market maker has few if any public comps, has a complex ownership structure, and derives most of its revenue from US equities market making, which is a fickle & volatile business to be in. Accurately predicting Virtu’s performance involves the unenviable, nearly impossible task of predicting market volatility.

In that respect, 2020 was a gangbuster year for Virtu’s market-making business. The company rode COVID market chaos to record revenues & nearly $6 in EPS (for a ~$30 stock, $6 in EPS is quite a feat). Virtu had finished deleveraging after its Knight Capital & ITG deals and had more than enough cash available to fund the trading business. Management therefore decided to return this excess cash to shareholders, announcing $170 million in stock buybacks by the end of 2020.

Analysts covering the stock expected Virtu to come back to Earth as 2021 began. Volatility was normalizing. Organic growth projects were progressing, but not enough to boost earnings in the short term. Q1 consensus estimates implied a nearly -40% drop in EPS vs. Q1 2020 as a result.

These estimates were completely shattered when Virtu reported revenue & EPS nearly twice as high as analysts were expecting. Turns out the market maker was able to ride extreme volatility for a little while longer, managing its business through the Reddit GameStop drama and the Archegos supernova later in the quarter. Once again, management found themselves with an influx of cash & again decided to return it to shareholders. Along with blowout earnings results Virtu announced another $300 million added to its buyback program, bringing the total authorization to $470 million. This a massive increase in buybacks, amounting to ~8% of shares outstanding at current prices. Management expects to execute these buybacks within the next 12 months.

I can’t predict future volatility. Although I’m willing to bet markets aren’t going to stay calm & quiet from here on out, I respect analysts & investors who may have that view. After Virtu’s update on capital return plans however, I don’t think future volatility matters all that much. Share buybacks tilt the risk/reward enough for me to stay long the stock despite short-term market calm.

Q1 2021 Industry “Losers”

#1: CME Group

I use the term “losers” here harshly, but if it applied to anyone this quarter, it would be CME. While there were a few bright spots in Q1 2021 - market data revenue growth looked strong & expense guidance has the potential to come down later in the year - the core factors driving CME’s stock price haven’t impressed me. Open interest, a signal of market participation & future trading volumes, has been flat to down since 2020. Interest rate volumes have recovered quarter-over-quarter but are still nowhere near pre-COVID levels.

The stock has performed well amid inflation worries and the impact it should have on interest rate markets, but volumes need to start matching the sentiment before I can get excited about further gains. I don’t think we’ll see real progress on the volume front until the Fed begins raising short term interest rates, which it likely won’t do this year or next depending on how long it wants inflation to run hot.

Additionally, I’m not excited about BrokerTec’s future prospects with renewed competition from Tradeweb on the horizon. As a refresher, CME’s BrokerTec has ~90% market share in dealer-to-dealer US Treasuries, the mature, highly electronic part of the market. The other 10% is controlled by Nasdaq’s eSpeed business, which was sold to Tradeweb earlier this year. I think Tradeweb’s combination of eSpeed with its large dealer-to-client business will give it a competitive edge over BrokerTec and allow it to begin to take market share. It’s also worth pointing out that Tradeweb CEO Lee Olesky founded BrokerTec before moving to his current role, making him the exact competitor BrokerTec does not want to find itself up against. The reasons I like Tradeweb are the same reasons I’m less optimistic about CME’s competitive prospects. I’m long both CME and Tradeweb at the moment, but wouldn’t be surprised if CME underperformed the market for the next quarter or two.

#2: MarketAxess

I touched on this a bit above, but MarketAxess is not living its best life so far in 2021. The stock has put up the worst YTD performance of all exchange stocks and is having its worst start to the year since 2014. The culprit? A noticeable slowdown in corporate bond electronic market share gains - April 2021 investment grade market share of 21.0% is only slightly higher than April 2020’s figure of 20.7%.

While a -25% selloff may seem like a harsh reaction to a minor slowdown in share growth, we need context. MarketAxess began the year trading at ~70x 2021 projected EPS, a difficult valuation to stomach even if share growth was off the charts. Even the slightest sign of a slowdown in growth was likely to prompt a selloff, and a slowdown in growth looks indeed to have come.

The stock is -25% off highs as of this writing; how much farther will it fall? I would consider initiating a position at ~50x forward earnings, or ~$400 per share. Shares have traded as low as 45x earnings in the recent past.

I believe MarketAxess is a great business that still has plenty of room to attract corporate bond traders away from the legacy bank dealers and onto its platform. The investment grade corporate bond market is currently ~30-35% electronic; I believe the market can become 85-90% electronic over time, with MarketAxess controlling the lion’s share of trading. How long it takes for this future to come true is the question investors need to balance against MKTX’s premium valuation. For now the stock’s valuation is contracting materially - the exchange will need to show a rebound in share growth before I can get excited about buying.

Honorable Mentions

New SEC Chair Gary Gensler made his first appearance before Congress this week, answering questions from lawmakers about the GameStop trading drama that took place a few months ago. During the hearing Gensler commented on the concentrated power of today’s market makers & called out Citadel in particular. He also stressed that recent gamification of markets warrants the SEC’s full attention to combat manipulation. You can read Gensler’s full prepared remarks from the hearing here.

CME made the decision to close most of its open outcry trading pits permanently, keeping only the Eurodollar options pit open from now own. The news comes as COVID lockdowns forced markets to become entirely electronic and squashed what little open outcry volume there was left.

S&P Global announced the launch of more cryptocurrency indices this year in partnership with blockchain data provider Lukka. In addition to a Bitcoin & Ethereum index, S&P Global is planning the launch of a “Crypto Mega Cap Index” which will track a diverse basket of cryptocurrencies, opening the door to institutional exposure to DeFi coins & assets.

Chart of the Week

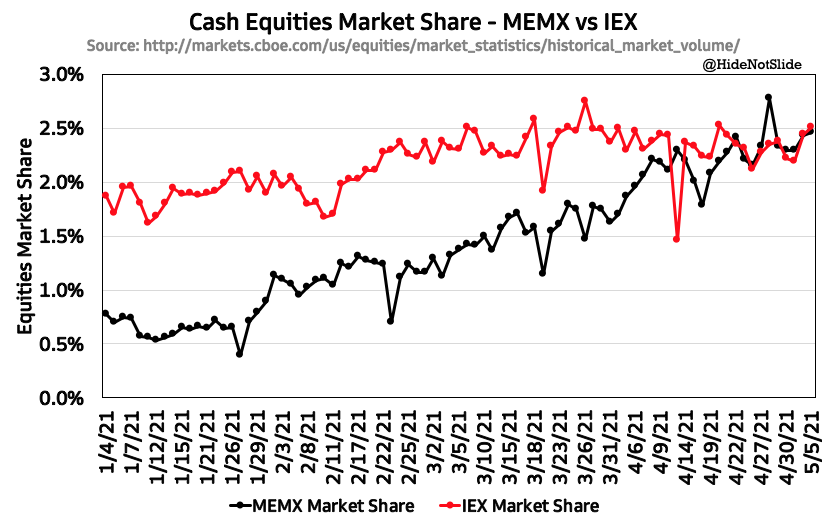

MEMX hit a milestone recently that merits another look at the startup exchange’s performance. In mid April, MEMX surpassed its more famous competitor IEX in trading volumes. It’s worth noting here that volume is measured in shares traded, not notional value where MEMX still lags. The exchange is using aggressive rebates to attract market share in low-price stocks and build liquidity, with the hope that larger notional sizes will come to the venue over time.

MEMX launched only eight months ago with powerful backers including Virtu, Citadel, Bank of American & Morgan Stanley, among others. Building any kind of meaningful market share in such a short period of time is no small feat, which speaks to the deep pockets of MEMX and its owners as it continues to underprice established exchanges.

Thank you for reading this issue of Front Month. Word of mouth is the #1 way others find this newsletter - If you liked this week’s content, please consider sharing with friends & colleagues. Questions & feedback can be sent via email or Twitter.

Disclaimer: I am not a financial advisor. Nothing on this site or in the Front Month newsletter should be considered investment advice. Any discussion about future results or projections may not pan out as expected. Do your own research & speak to a licensed professional before making any investment decisions. As of the publishing of this newsletter, I am long ICE, CME, TW, NDAQ and VIRT. I am also long Bitcoin and Uniswap’s UNI governance token.